FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Vote for your favorite vizzies from the Power BI Dataviz World Championship submissions. Vote now!

- Power BI forums

- Forums

- Get Help with Power BI

- Power Query

- Re: Adding columns or rows for missing data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding columns or rows for missing data

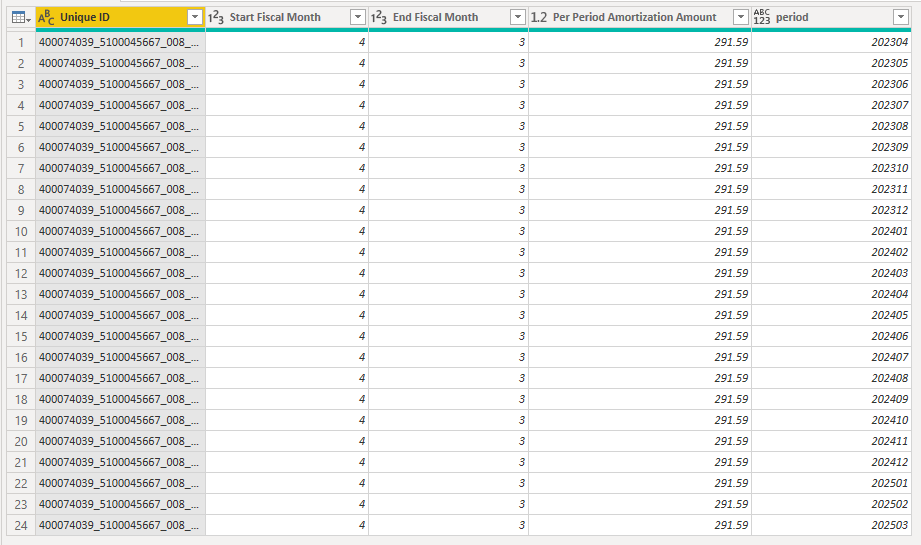

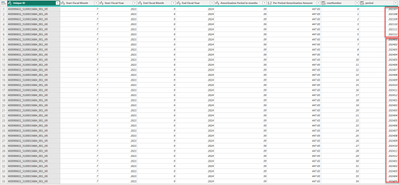

I have a set of data related to amortization of costs that looks like below:

| Unique ID | Fiscal Year | Posting Period | Vendor | Amount in local currency | Start Fiscal Month | Start Fiscal Year | End Fiscal Month | End Fiscal Year | Amortization Period in months | Per Period Amortization Amount | Jul'22 | Aug'22 | Sep'22 | Oct'22 | Nov'22 | Dec'22 | Jan'23 | Feb'23 | Mar'23 | Apr'23 | May'23 | Jun'23 | Current FY Amortization Months Planned | No of Months Amortized | No of Amortization Months Outstanding | Months greater than 12 | Current Amount | Non Current Amount | Actual Prepaid Exp Balance |

| 400074039_5100045667_008_KR | 2023 | 5 | 400074039 | 3499.12 | 4 | 2023 | 3 | 2024 | 12 | 291.59 | 0 | 0 | 0 | 291.59 | 291.59 | 291.59 | 291.59 | 291.59 | 291.59 | 291.59 | 291.59 | 291.59 | 9 | 6 | 6 | 0 | 1749.58 | 0 | 1749.58 |

Unfortunately the monthly amortization amount is shown only for the months in the current fiscal year (2023). However, the amortization extends into future fiscal years (2024 in the sameple above). The months in the next financial year are shown in End Fiscal Month and End Fiscal Year. In this case month 4 for 2024. The full period of the amortization (12 months in this case) is in Period in Months. The monthly amortization amount is shown in Per Period Amortization Amount.

I would like to create visualizations and do other analysis that requires that the months be extended to include the future fiscal years with the correct amount entered for each of the future fiscal year months.

Does anybody have any suggestions? I have tried unpivoting the data and then I thought I could do some sort of fill-down but am stuck as the number of lines to fill down by depends on how many months of amortization exist for how many future months/future years. The unpivoted data looks like this:

| Unique ID | Start Fiscal Month | Start Fiscal Year | End Fiscal Month | End Fiscal Year | Current FY Amortization Months Planned | No of Months Amortized | No of Amortization Months Outstanding | Attribute | Value |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jul'22 | 0 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Aug'22 | 0 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Sep'22 | 0 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Oct'22 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Nov'22 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Dec'22 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jan'23 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Feb'23 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Mar'23 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Apr'23 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | May'23 | 291.59 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jun'23 | 291.59 |

If I merge in a date table I get the extra rows but need a way to complete only those rows that have valid amortization amounts in the future years/months:

| Unique ID | Start Fiscal Month | Start Fiscal Year | End Fiscal Month | End Fiscal Year | Current FY Amortization Months Planned | No of Months Amortized | No of Amortization Months Outstanding | Month.1 | Month.2 | Amortization | Month.1 Full | Fiscal Month Number | Fiscal Year Month Number |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jul | 2022 | 0 | July | 1 | 202301 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Aug | 2022 | 0 | August | 2 | 202302 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Sep | 2022 | 0 | September | 3 | 202303 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Oct | 2022 | 291.59 | October | 4 | 202304 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Nov | 2022 | 291.59 | November | 5 | 202305 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Dec | 2022 | 291.59 | December | 6 | 202306 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jan | 2023 | 291.59 | January | 7 | 202307 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Feb | 2023 | 291.59 | February | 8 | 202308 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Mar | 2023 | 291.59 | March | 9 | 202309 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Apr | 2023 | 291.59 | April | 10 | 202310 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | May | 2023 | 291.59 | May | 11 | 202311 |

| 400074039_5100045667_008_KR | 4 | 2023 | 3 | 2024 | 9 | 6 | 6 | Jun | 2023 | 291.59 | June | 12 | 202312 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202401 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202402 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202403 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202404 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202405 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202406 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202407 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202408 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202409 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202410 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202411 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202412 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202501 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202502 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202503 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202504 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202505 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202506 |

| null | null | null | null | null | null | null | null | null | null | null | null | null | 202507 |

Does anybody have any ideas or pointers?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No. Should be doable just using a slightly different year calculation.

--UPDATE-- @vgeldbr Try this:

let

Source = Table.FromRows(Json.Document(Binary.Decompress(Binary.FromText("Jci7DcAgDIThXVxH6PyCeIZ0aRHy/ltgkuJ0n/45yQAMg0Y6F817Hwnc+bx0kVpEYylZTSB64k8/9+Xg5kFrbQ==", BinaryEncoding.Base64), Compression.Deflate)), let _t = ((type nullable text) meta [Serialized.Text = true]) in type table [#"Unique ID" = _t, #"Amount in local currency" = _t, #"Start Fiscal Month" = _t, #"Start Fiscal Year" = _t, #"End Fiscal Month" = _t, #"End Fiscal Year" = _t, #"Amortization Period in months" = _t, #"Per Period Amortization Amount" = _t]),

chgTypes = Table.TransformColumnTypes(Source,{{"Amount in local currency", type number}, {"Start Fiscal Month", Int64.Type}, {"Start Fiscal Year", Int64.Type}, {"End Fiscal Month", Int64.Type}, {"End Fiscal Year", Int64.Type}, {"Amortization Period in months", Int64.Type}, {"Per Period Amortization Amount", type number}}),

addRowNumber = Table.AddColumn(chgTypes, "rowNumber", each {0..[Amortization Period in months] - 1}),

expandRowNumber = Table.ExpandListColumn(addRowNumber, "rowNumber"),

addPeriod =

Table.AddColumn(

expandRowNumber,

"period",

each let

year = Text.From([Start Fiscal Year] + (Number.RoundUp(([Start Fiscal Month] + [rowNumber]) / 12) - 1)),

month = Text.PadStart(Text.From(Number.Mod([Start Fiscal Month] + [rowNumber] - 1, 12) + 1), 2, "0")

in

Number.From(Text.Combine({year, month}))),

remOthCols = Table.SelectColumns(addPeriod,{"Unique ID", "Start Fiscal Month", "End Fiscal Month", "Per Period Amortization Amount", "period"})

in

remOthCols

To get this:

Pete

Now accepting Kudos! If my post helped you, why not give it a thumbs-up?

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

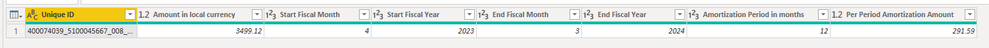

Hi @vgeldbr ,

The below query turns this:

...into this:

let

Source = Table.FromRows(Json.Document(Binary.Decompress(Binary.FromText("i45WMjEwMDA3MTC2jDc1BDJNTM3MzOMNDCzivYOUdJSMTSwt9QyNgCwTIDYyMDIGCUKYIBGwlJGloZ6ppVJsLAA=", BinaryEncoding.Base64), Compression.Deflate)), let _t = ((type nullable text) meta [Serialized.Text = true]) in type table [#"Unique ID" = _t, #"Amount in local currency" = _t, #"Start Fiscal Month" = _t, #"Start Fiscal Year" = _t, #"End Fiscal Month" = _t, #"End Fiscal Year" = _t, #"Amortization Period in months" = _t, #"Per Period Amortization Amount" = _t]),

chgTypes = Table.TransformColumnTypes(Source,{{"Amount in local currency", type number}, {"Start Fiscal Month", Int64.Type}, {"Start Fiscal Year", Int64.Type}, {"End Fiscal Month", Int64.Type}, {"End Fiscal Year", Int64.Type}, {"Amortization Period in months", Int64.Type}, {"Per Period Amortization Amount", type number}}),

addDtStartMonth = Table.AddColumn(chgTypes, "dtStartMonth", each Date.StartOfMonth(

#date(

[Start Fiscal Year],

[Start Fiscal Month],

01

)

)),

addDtEndMonth = Table.AddColumn(addDtStartMonth, "dtEndMonth", each Date.EndOfMonth(

#date(

[End Fiscal Year],

[End Fiscal Month],

01

)

)),

addMonthList =

Table.AddColumn(

addDtEndMonth,

"monthList",

each List.Distinct(

List.Transform(

{ Number.From([dtStartMonth])..Number.From([dtEndMonth]) },

each Date.StartOfMonth(Date.From(_))

)

)

),

expandMonthList = Table.ExpandListColumn(addMonthList, "monthList"),

remOthCols = Table.SelectColumns(expandMonthList,{"Unique ID", "Start Fiscal Month", "Start Fiscal Year", "End Fiscal Month", "End Fiscal Year", "Per Period Amortization Amount", "monthList"})

in

remOthCols

It looks pretty big and complicated, but in summary, it's just:

-1- addDtStartMonth = Convert your start month/year into a proper date

-2- addDtEndMonth = Convert your end month/year into a proper date

-3- addMonthLisy = Create a list of dates between these two

-4- expandMonthList = Expand the list of dates to new rows

I imagine you'll need to do a bit of jiggery-pokery with the date calculations so they work as fiscal periods rather than calendar months, but this basic structure is the way to go, I think.

Pete

Now accepting Kudos! If my post helped you, why not give it a thumbs-up?

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@BA_Pete this is fantastic. Thanks!

I'm stuck on taking this further as our real world is a bit more complex. We use fiscal months not calendar months (544 week model). I have a standard date table I can use.

In our world Fiscal Year runs from July to June with Month 1 = July and Month 11 = June. But the 544 week model means the fiscal months do not fall into the calendar months.

What I am unable to figure out now is in this step:

addMonthList =

Table.AddColumn(

addDtEndMonth,

"monthList",

each List.Distinct(

List.Transform(

{ Number.From([dtStartMonth])..Number.From([dtEndMonth]) },

each Date.StartOfMonth(Date.From(_))

)

)

),I need to generate a list of fiscal months not calendar months. I thought I could just generate the YearMonths (e.g. 202303, 202304 ... 202402) and then use my date table to join the actual months but nothing I've tried works. I must be missing some magic in how the numbers are converted back to dates.

Any further thoughts/ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

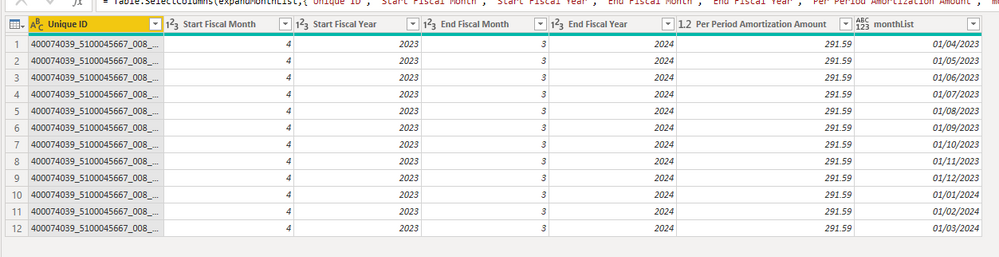

Hi @vgeldbr ,

Try this:

let

Source = Table.FromRows(Json.Document(Binary.Decompress(Binary.FromText("i45WMjEwMDA3MTC2jDc1BDJNTM3MzOMNDCzivYOUdJSMTSwt9QyNgCwTIDYyMDIGCUKYIBGwlJGloZ6ppVJsLAA=", BinaryEncoding.Base64), Compression.Deflate)), let _t = ((type nullable text) meta [Serialized.Text = true]) in type table [#"Unique ID" = _t, #"Amount in local currency" = _t, #"Start Fiscal Month" = _t, #"Start Fiscal Year" = _t, #"End Fiscal Month" = _t, #"End Fiscal Year" = _t, #"Amortization Period in months" = _t, #"Per Period Amortization Amount" = _t]),

chgTypes = Table.TransformColumnTypes(Source,{{"Amount in local currency", type number}, {"Start Fiscal Month", Int64.Type}, {"Start Fiscal Year", Int64.Type}, {"End Fiscal Month", Int64.Type}, {"End Fiscal Year", Int64.Type}, {"Amortization Period in months", Int64.Type}, {"Per Period Amortization Amount", type number}}),

addRowNumber = Table.AddColumn(chgTypes, "rowNumber", each {0..[Amortization Period in months] - 1}),

expandRowNumber = Table.ExpandListColumn(addRowNumber, "rowNumber"),

addPeriod =

Table.AddColumn(

expandRowNumber,

"period",

each let

year = Text.From(if [Start Fiscal Month] + [rowNumber] > 12 then [End Fiscal Year] else [Start Fiscal Year]),

month = Text.PadStart(Text.From(Number.Mod([Start Fiscal Month] + [rowNumber] - 1, 12) + 1), 2, "0")

in

Number.From(Text.Combine({year, month}))

),

remOthCols = Table.SelectColumns(addPeriod,{"Unique ID", "Start Fiscal Month", "Start Fiscal Year", "End Fiscal Month", "End Fiscal Year", "Amortization Period in months", "Per Period Amortization Amount", "period"})

in

remOthCols

To get this output:

Pete

Now accepting Kudos! If my post helped you, why not give it a thumbs-up?

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@BA_Pete so close!! It works perfectly where amortization spreads only from current year to the next year but if the amortization is over a longer period (e.g. 2021 to 2024) then it breaks. I guess I need to generate a separate list of fiscal years between the Start Fiscal Year and the End Fiscal Year with the Fiscal Months separate and then merge them to form the period (ie. 202107 to 202409).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

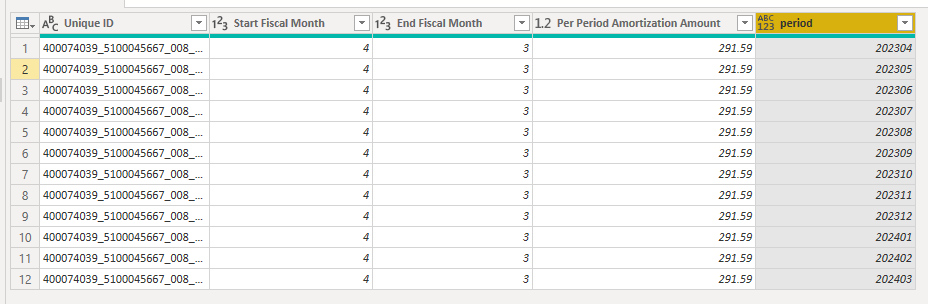

No. Should be doable just using a slightly different year calculation.

--UPDATE-- @vgeldbr Try this:

let

Source = Table.FromRows(Json.Document(Binary.Decompress(Binary.FromText("Jci7DcAgDIThXVxH6PyCeIZ0aRHy/ltgkuJ0n/45yQAMg0Y6F817Hwnc+bx0kVpEYylZTSB64k8/9+Xg5kFrbQ==", BinaryEncoding.Base64), Compression.Deflate)), let _t = ((type nullable text) meta [Serialized.Text = true]) in type table [#"Unique ID" = _t, #"Amount in local currency" = _t, #"Start Fiscal Month" = _t, #"Start Fiscal Year" = _t, #"End Fiscal Month" = _t, #"End Fiscal Year" = _t, #"Amortization Period in months" = _t, #"Per Period Amortization Amount" = _t]),

chgTypes = Table.TransformColumnTypes(Source,{{"Amount in local currency", type number}, {"Start Fiscal Month", Int64.Type}, {"Start Fiscal Year", Int64.Type}, {"End Fiscal Month", Int64.Type}, {"End Fiscal Year", Int64.Type}, {"Amortization Period in months", Int64.Type}, {"Per Period Amortization Amount", type number}}),

addRowNumber = Table.AddColumn(chgTypes, "rowNumber", each {0..[Amortization Period in months] - 1}),

expandRowNumber = Table.ExpandListColumn(addRowNumber, "rowNumber"),

addPeriod =

Table.AddColumn(

expandRowNumber,

"period",

each let

year = Text.From([Start Fiscal Year] + (Number.RoundUp(([Start Fiscal Month] + [rowNumber]) / 12) - 1)),

month = Text.PadStart(Text.From(Number.Mod([Start Fiscal Month] + [rowNumber] - 1, 12) + 1), 2, "0")

in

Number.From(Text.Combine({year, month}))),

remOthCols = Table.SelectColumns(addPeriod,{"Unique ID", "Start Fiscal Month", "End Fiscal Month", "Per Period Amortization Amount", "period"})

in

remOthCols

To get this:

Pete

Now accepting Kudos! If my post helped you, why not give it a thumbs-up?

Proud to be a Datanaut!

Helpful resources

Power BI Dataviz World Championships

Vote for your favorite vizzies from the Power BI World Championship submissions!

Join our Community Sticker Challenge 2026

If you love stickers, then you will definitely want to check out our Community Sticker Challenge!

Power BI Monthly Update - January 2026

Check out the January 2026 Power BI update to learn about new features.

| User | Count |

|---|---|

| 6 | |

| 5 | |

| 5 | |

| 4 | |

| 3 |

| User | Count |

|---|---|

| 11 | |

| 7 | |

| 6 | |

| 6 | |

| 6 |