FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Get Fabric Certified for FREE during Fabric Data Days. Don't miss your chance! Request now

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Conditional format asset returns based upon we...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Conditional format asset returns based upon weight Averages

Hi

Really would appreciate someones help on this.

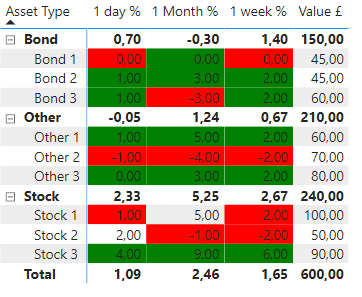

I have a table containing the value and returns (e.g. 1 day%, 1 week %,1 month%) for a range of assets grouped into different categories. A simplified dat table would look like this:

| Asset Type | Asset Name | Value £ | 1 day % | 1 week % | 1 Month % |

| Stock | Stock 1 | 100 | 1 | 2 | 5 |

| Stock | Stock2 | 50 | 2 | -2 | -1 |

| Stock | Stock 3 | 90 | 4 | 6 | 9 |

| Bond | Bond 1 | 45 | 0 | 0 | 0 |

| Bond | Bond 2 | 45 | 1 | 2 | 3 |

| Bond | Bond 3 | 60 | 1 | 2 | -3 |

| Other | Other 1 | 60 | 1 | 2 | 5 |

| Other | Other 2 | 70 | -1 | -2 | -4 |

| Other | Other 3 | 80 | 0 | 2 | 3 |

I would like to create a matrix which computes weight average return by Asset Type and an overal weight average return for each period. In excel it looks like this:

| Value £ | 1 day % | 1 week % | 1 Month % | |

| Stocks | 240 | 2.33 | 2.67 | 5.25 |

| Stock 1 | 100 | 1 | 2 | 5 |

| Stock2 | 50 | 2 | -2 | -1 |

| Stock 3 | 90 | 4 | 6 | 9 |

| Bonds | 150 | 0.70 | 1.40 | -0.30 |

| Bond 1 | 45 | 0 | 0 | 0 |

| Bond 2 | 45 | 1 | 2 | 3 |

| Bond 3 | 60 | 1 | 2 | -3 |

| Other | 210 | -0.05 | 0.67 | 1.24 |

| Other 1 | 60 | 1 | 2 | 5 |

| Other 2 | 70 | -1 | -2 | -4 |

| Other 3 | 80 | 0 | 2 | 3 |

| Weighted Av. | 1.09 | 2.40 | 3.04 |

I would then like to conditionally colour each cell based on:

If cell value is greater than 1.2 x weighted average for period - Green

If cell value is less than 0.8 x weighted average for period - Red

I am hoping I can do the calculations in the matrix without having to create lots of measures per return period as there are 8 periods X 11 asset types x 40 assets.

All inputs gratefully received

Kind regards

Ian

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

If the calculations is correct then for the condittional formatting use the following measure:

Conditional_Formatting =

VAR temp_table =

SUMMARIZE (

ALL ( Assets[Asset Name], Assets[Asset Type], Assets[Attribute], Assets[Value] ),

Assets[Attribute],

"Total Value", [Values]

)

RETURN

SWITCH (

TRUE (),

SELECTEDVALUE ( Period[Period] ) = "Value £", BLANK (),

[Values]

> SUMX ( temp_table, [Total Value] ) * 1.2, "Green",

[Values]

< SUMX ( temp_table, [Total Value] ) * 0.8, "Red"

)

Don't forget to mark the correct answer to help others.

PBIX file attach.

Regards

Miguel Félix

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Check out my blog: Power BI em Português- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous ,

Redo the measure to:

Conditional_Formatting =

VAR temp_table =

SUMMARIZE (

ALLSELECTED (

Assets[Asset Type],

Assets[Attribute],

Assets[Asset Name],

Assets[Value]

),

Assets[Attribute],

Assets[Asset Type],

"Total Value", [Values]

)

VAR AssetTypeTotal =

SUMX (

FILTER ( temp_table, Assets[Asset Type] = SELECTEDVALUE ( Assets[Asset Type] ) ),

[Total Value]

)

RETURN

IF (

ISFILTERED ( Assets[Asset Name] ),

SWITCH (

TRUE (),

SELECTEDVALUE ( Period[Period] ) = "Value £", BLANK (),

[Values] > AssetTypeTotal * 1.2, "Green",

[Values] < AssetTypeTotal * 0.8, "Red"

)

)

Regards

Miguel Félix

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Check out my blog: Power BI em Português- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which measure do I then use to do the conditional format of each cell based on Column Average +/- 20%?

Many thanks

Ian

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @MFelix

Having checked my final row columns seems I have a maths error in week and month returns your values are perfectly correct 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

If the calculations is correct then for the condittional formatting use the following measure:

Conditional_Formatting =

VAR temp_table =

SUMMARIZE (

ALL ( Assets[Asset Name], Assets[Asset Type], Assets[Attribute], Assets[Value] ),

Assets[Attribute],

"Total Value", [Values]

)

RETURN

SWITCH (

TRUE (),

SELECTEDVALUE ( Period[Period] ) = "Value £", BLANK (),

[Values]

> SUMX ( temp_table, [Total Value] ) * 1.2, "Green",

[Values]

< SUMX ( temp_table, [Total Value] ) * 0.8, "Red"

)

Don't forget to mark the correct answer to help others.

PBIX file attach.

Regards

Miguel Félix

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Check out my blog: Power BI em Português- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @MFelix

Many thanks for your solution which works perfectly !!

One last question on this I promise 🙂

Is there a way to apply the +/- conditional formatting based upon the weight average of the Subtotal in the column rather than the whole column

i.e. stocks measured +/- 20% against weighted average of Stock for the return period not the total weighted average for the return period.

Hopefully I have explained that clearly enough?

Kind regards

Ian

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous ,

Redo the measure to:

Conditional_Formatting =

VAR temp_table =

SUMMARIZE (

ALLSELECTED (

Assets[Asset Type],

Assets[Attribute],

Assets[Asset Name],

Assets[Value]

),

Assets[Attribute],

Assets[Asset Type],

"Total Value", [Values]

)

VAR AssetTypeTotal =

SUMX (

FILTER ( temp_table, Assets[Asset Type] = SELECTEDVALUE ( Assets[Asset Type] ) ),

[Total Value]

)

RETURN

IF (

ISFILTERED ( Assets[Asset Name] ),

SWITCH (

TRUE (),

SELECTEDVALUE ( Period[Period] ) = "Value £", BLANK (),

[Values] > AssetTypeTotal * 1.2, "Green",

[Values] < AssetTypeTotal * 0.8, "Red"

)

)

Regards

Miguel Félix

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Check out my blog: Power BI em Português- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous ,

You can do the following:

- Unpivot the period columns on your data

- Create a new table using the following code:

Period = UNION(DISTINCT('Assets'[Attribute]); {"Value £"})- Create the following measure:

Values =

IF (

SELECTEDVALUE ( 'Period'[Attribute] ) = "Value £";

SUMX ( VALUES ( 'Assets'[Asset Name] ); AVERAGE ( 'Assets'[Value £] ) );

CALCULATE (

SUMX ( 'Assets'; 'Assets'[Value] * 'Assets'[Value £] )

/ SUM ( 'Assets'[Value £] );

FILTER (

ALLSELECTED ( 'Assets'[Attribute] );

'Assets'[Attribute] = SELECTEDVALUE ( 'Period'[Attribute] )

)

)

)

- Configure your matrix in the following way:

- Rows:

- Asset Type

- Asset Name

- Columns

- Periods from the Period table

- Values

- Values measure

- Rows:

Result below and in attach PBIX file:

I have only one question regarding the last line of the Weight average on the last line how are you calculating the values since all the calculations I have tried don't give the same value.

Regards

Miguel Félix

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Check out my blog: Power BI em Português- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi Miguel

Many thanks for a super quick and comprehensive response I will download and try out the attached file.

The last lien of weighted averages is just a weighted average of the subtotals to give an overal average. I t should come to the same answer as taking all the individual line items.

ie

(Sub total Shares * Total value Shares + sub Total Bonds * Total Value Bond + sub Total Other * Total Value Other)/ Total Value

Helpful resources

Power BI Monthly Update - November 2025

Check out the November 2025 Power BI update to learn about new features.

Fabric Data Days

Advance your Data & AI career with 50 days of live learning, contests, hands-on challenges, study groups & certifications and more!