FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now! Learn more

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Accumulated Return

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accumulated Return

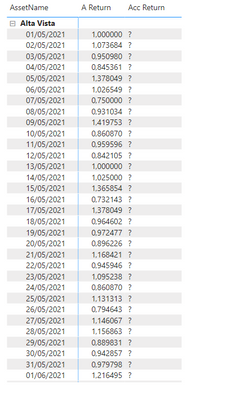

Just figure it out how to calculate if my model was a flat table. But i have a multi dimensional model like :

I need a measure to calculate the accumulated return (ProductX) for each fund. here is my sample.

I'm trying to adapt this code with no success:

cumul_norm_return_summarizefree =

CALCULATE(

PRODUCTX( ALLSELECTED(perf[date]), (1+[norm_return]))-1,

FILTER(

ALLSELECTED(perf), perf[date]<=MAX([date]) &&

perf[fund] IN FILTERS(perf[fund])

)

)

Thank you in advance.

Update 9/12:

I got the expected result using this code in transactions table:

Acc Return =

CALCULATE(

PRODUCTX(Transactions,[Return]),

FILTER(ALL(Transactions[Data]),

Transactions[Data]<=MAX(Transactions[Data])

)

)

But I´m curious regarding the Date Table. How can I accomplish the result using dates from date dimension?

Best Regards

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

The following measure would work

Cumulative Return =

VAR __AvailableTransactionDates = VALUES('Transactions'[Date])

VAR __FirstAvailableTransactionDate =

MINX(__AvailableTransactionDates, 'Transactions'[Date])

VAR __LastAvailableTransactionDate =

MAXX(__AvailableTransactionDates, 'Transactions'[Date])

VAR __IsSingleDateFiltered = HASONEVALUE('Date'[Date])

VAR __SelectedDates = ALLSELECTED('Date'[Date])

VAR __MinSelectedDate = MINX(__SelectedDates, 'Date'[Date])

VAR __CurrentDate = MAX('Date'[Date])

VAR __IsMaxDateInTranRange =

__CurrentDate <= __LastAvailableTransactionDate

VAR __IsMinDateInTranRange =

__MinSelectedDate >= __FirstAvailableTransactionDate

VAR __IsSingleAssetSelected = HASONEVALUE(Asset[AssetName])

VAR __CumReturnPeriod =

FILTER(

__SelectedDates,

'Date'[Date] >= __MinSelectedDate

&& 'Date'[Date] <= __CurrentDate

)

VAR __DailyReturnsUptoCurrentPeriod =

CALCULATETABLE(

SUMMARIZE(

Transactions,

Transactions[Date],

Transactions[Return]

),

REMOVEFILTERS('Date'),

__CumReturnPeriod

)

VAR __CumulativeReturn =

IF(

(

__IsSingleAssetSelected

&& __IsSingleDateFiltered

&& __IsMaxDateInTranRange

)

||

(

__IsSingleAssetSelected

&& NOT(__IsSingleDateFiltered)

&& __IsMaxDateInTranRange

&& __IsMinDateInTranRange

),

PRODUCTX(

__DailyReturnsUptoCurrentPeriod,

'Transactions'[Return]

) - 1

)

RETURN

__CumulativeReturnI've also uploaded the file here.

If this answers your query, please mark it as the solution and a thumbs up would be great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@askhanduja solution actually gave me this insight:

Return Amount RP =

VAR CurrentDate = MAX ( 'Date'[Date] )

VAR FirstVisibleDate = MINX(ALLSELECTED('Date'[Date]), ('Date'[Date]))

VAR Result =

CALCULATE (

PRODUCTX(Transactions,[Return]),

DATESBETWEEN('Date'[Date],FirstVisibleDate,CurrentDate)

)

RETURN

Result

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

The following measure would work

Cumulative Return =

VAR __AvailableTransactionDates = VALUES('Transactions'[Date])

VAR __FirstAvailableTransactionDate =

MINX(__AvailableTransactionDates, 'Transactions'[Date])

VAR __LastAvailableTransactionDate =

MAXX(__AvailableTransactionDates, 'Transactions'[Date])

VAR __IsSingleDateFiltered = HASONEVALUE('Date'[Date])

VAR __SelectedDates = ALLSELECTED('Date'[Date])

VAR __MinSelectedDate = MINX(__SelectedDates, 'Date'[Date])

VAR __CurrentDate = MAX('Date'[Date])

VAR __IsMaxDateInTranRange =

__CurrentDate <= __LastAvailableTransactionDate

VAR __IsMinDateInTranRange =

__MinSelectedDate >= __FirstAvailableTransactionDate

VAR __IsSingleAssetSelected = HASONEVALUE(Asset[AssetName])

VAR __CumReturnPeriod =

FILTER(

__SelectedDates,

'Date'[Date] >= __MinSelectedDate

&& 'Date'[Date] <= __CurrentDate

)

VAR __DailyReturnsUptoCurrentPeriod =

CALCULATETABLE(

SUMMARIZE(

Transactions,

Transactions[Date],

Transactions[Return]

),

REMOVEFILTERS('Date'),

__CumReturnPeriod

)

VAR __CumulativeReturn =

IF(

(

__IsSingleAssetSelected

&& __IsSingleDateFiltered

&& __IsMaxDateInTranRange

)

||

(

__IsSingleAssetSelected

&& NOT(__IsSingleDateFiltered)

&& __IsMaxDateInTranRange

&& __IsMinDateInTranRange

),

PRODUCTX(

__DailyReturnsUptoCurrentPeriod,

'Transactions'[Return]

) - 1

)

RETURN

__CumulativeReturnI've also uploaded the file here.

If this answers your query, please mark it as the solution and a thumbs up would be great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Helpful resources

Power BI Dataviz World Championships

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now!

| User | Count |

|---|---|

| 41 | |

| 38 | |

| 36 | |

| 31 | |

| 28 |

| User | Count |

|---|---|

| 129 | |

| 88 | |

| 79 | |

| 68 | |

| 63 |