FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now! Learn more

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Performance 1Y/3Y//5y DAX Calculations

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Performance 1Y/3Y//5y DAX Calculations

Hi All

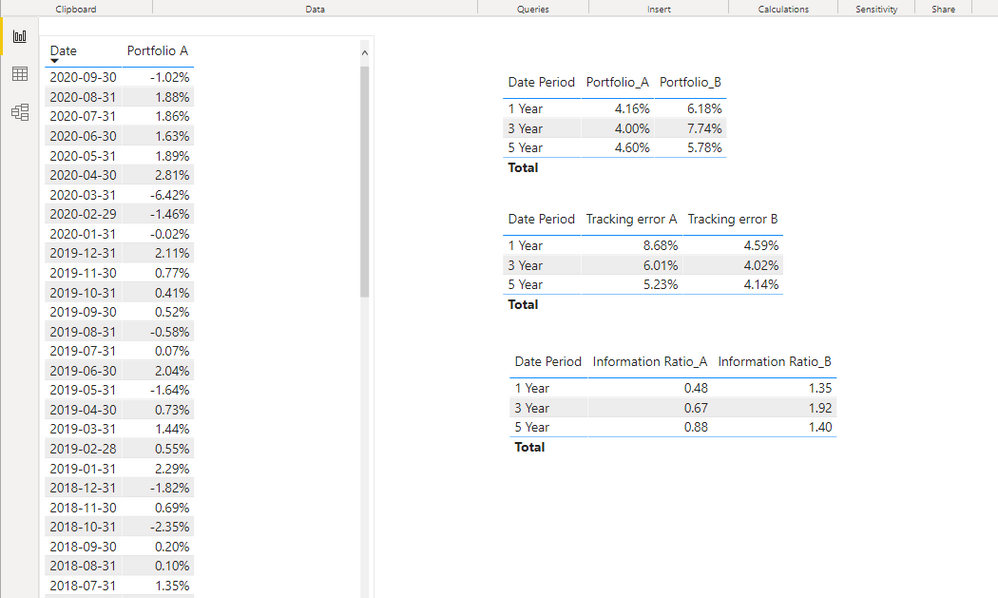

I am trying to create a DAX to calculate 1Y/3Y/5Y performance metrics on a monthly stream of returns. Annualised performance for those periods, Tracking error/standard deviation calcs and another but that one may well be simple enough.

I can manage it for YTD calcs (see below) but I need to do it for the set period from the most recent date in the dataset.

| Date | RegionModelType | Model_Return |

| Date | Portfolio A | Portfolio B |

| 30-Sep-20 | -1.02% | 1.35% |

| 31-Aug-20 | 1.88% | 0.15% |

| 31-Jul-20 | 1.86% | 0.85% |

| 30-Jun-20 | 1.63% | 0.97% |

| 31-May-20 | 1.89% | -0.80% |

| 30-Apr-20 | 2.81% | 2.04% |

| 31-Mar-20 | -6.42% | -1.64% |

| 29-Feb-20 | -1.46% | 0.73% |

| 31-Jan-20 | -0.02% | 1.44% |

| 31-Dec-19 | 2.11% | 0.55% |

| 30-Nov-19 | 0.77% | 2.29% |

| 31-Oct-19 | 0.41% | -1.82% |

| 30-Sep-19 | 0.52% | 0.69% |

| 31-Aug-19 | -0.58% | 0.20% |

| 31-Jul-19 | 0.07% | 0.10% |

| 30-Jun-19 | 2.04% | 2.11% |

| 31-May-19 | -1.64% | 1.89% |

| 30-Apr-19 | 0.73% | 2.81% |

| 31-Mar-19 | 1.44% | 0.41% |

| 28-Feb-19 | 0.55% | 0.52% |

| 31-Jan-19 | 2.29% | -0.58% |

| 31-Dec-18 | -1.82% | 0.07% |

| 30-Nov-18 | 0.69% | 2.04% |

| 31-Oct-18 | -2.35% | -1.64% |

| 30-Sep-18 | 0.20% | 0.73% |

| 31-Aug-18 | 0.10% | 1.44% |

| 31-Jul-18 | 1.35% | 2.04% |

| 30-Jun-18 | 0.15% | -1.64% |

| 31-May-18 | 0.85% | 0.73% |

| 30-Apr-18 | 0.97% | 1.44% |

| 31-Mar-18 | -0.80% | 0.55% |

| 28-Feb-18 | -1.40% | 0.20% |

| 31-Jan-18 | 0.84% | 0.10% |

| 31-Dec-17 | 1.60% | 1.35% |

| 30-Nov-17 | -0.02% | 0.15% |

| 31-Oct-17 | 2.11% | 0.85% |

| 30-Sep-17 | 0.77% | 0.97% |

| 31-Aug-17 | 0.41% | 0.41% |

| 31-Jul-17 | 0.52% | 0.52% |

| 30-Jun-17 | -0.58% | 2.29% |

| 31-May-17 | 0.07% | -1.82% |

| 30-Apr-17 | 2.04% | 0.69% |

| 31-Mar-17 | -1.64% | 0.20% |

| 28-Feb-17 | 0.73% | 0.10% |

| 31-Jan-17 | 1.44% | -1.64% |

| 31-Dec-16 | 0.55% | 0.73% |

| 30-Nov-16 | 2.29% | 1.44% |

| 31-Oct-16 | -1.82% | 2.04% |

| 30-Sep-16 | 0.69% | -1.64% |

| 31-Aug-16 | 0.20% | 0.41% |

| 31-Jul-16 | 0.10% | 0.52% |

| 30-Jun-16 | 1.35% | -0.58% |

| 31-May-16 | 0.15% | -1.64% |

| 30-Apr-16 | 0.85% | 0.73% |

| 31-Mar-16 | 0.97% | 1.44% |

| 29-Feb-16 | -0.80% | 2.04% |

| 31-Jan-16 | 2.04% | -1.64% |

| 31-Dec-15 | -1.64% | 0.41% |

| 30-Nov-15 | 0.73% | 0.52% |

| 31-Oct-15 | 1.44% | -0.58% |

| 30-Sep-15 | 0.55% | 0.07% |

| 31-Aug-15 | 2.29% | 2.29% |

| 31-Jul-15 | -1.82% | -1.82% |

| 30-Jun-15 | 0.69% | 0.69% |

| 31-May-15 | 0.20% | 0.20% |

| 30-Apr-15 | 0.10% | 0.10% |

| 31-Mar-15 | 2.11% | 2.11% |

| 28-Feb-15 | 1.89% | 1.89% |

| 31-Jan-15 | 2.81% | 2.81% |

| Portfolio Performance | Portfolio A | Portfolio B | Formula |

| 1 Year | 4.15% | 6.17% | =IFERROR(PRODUCT(1+B2:B13)-1,"") |

| 3 Year | 3.99% | 7.72% | =IFERROR(PRODUCT(1+B2:B37)^(1/3)-1,"") |

| 5 Year | 4.58% | 5.77% | =IFERROR(PRODUCT(1+B2:B61)^(1/5)-1,"") |

| Tracking Error | Portfolio A | Portfolio B | Formula |

| 1 Year | 8.67% | 4.59% | =STDEV(B2:B13)*SQRT(12) |

| 3 Year | 6.00% | 4.02% | =STDEV(B2:B37)*SQRT(12) |

| 5 Year | 5.22% | 4.14% | =STDEV(B2:B61)*SQRT(12) |

| Information Ratio | Portfolio A | Portfolio B | Formula |

| 1 Year | 0.48 | 1.34 | =IFERROR(F3/F8,"") |

| 3 Year | 0.66 | 1.92 | =IFERROR(F4/F9,"") |

| 5 Year | 0.88 | 1.40 | =IFERROR(F5/F10,"") |

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, @JamesB86

Try formula as below:

calculated table:

Table 1 = DATATABLE("Date Period",STRING,{{"1 Year"},{"3 Year"},{"5 Year"}})Measure:

Portfolio_A =

VAR tab1 =

TOPN ( 12, Fact_Table, Fact_Table[Date], DESC )

VAR tab2 =

TOPN ( 36, Fact_Table, Fact_Table[Date], DESC )

VAR tab3 =

TOPN ( 60, Fact_Table, Fact_Table[Date], DESC )

VAR PortfolioA =

SWITCH (

SELECTEDVALUE ( 'Table 1'[Date Period] ),

"1 Year",

PRODUCTX ( tab1, 1 + [Portfolio A] ) - 1,

"3 Year",

PRODUCTX ( tab2, 1 + [Portfolio A] ) ^ ( 1 / 3 ) - 1,

"5 Year",

PRODUCTX ( tab3, 1 + [Portfolio A] ) ^ ( 1 / 5 ) - 1

)

RETURN

IFERROR ( PortfolioA, "" )Tracking error A =

VAR tab1 =

TOPN ( 12, Fact_Table, Fact_Table[Date], DESC )

VAR tab2 =

TOPN ( 36, Fact_Table, Fact_Table[Date], DESC )

VAR tab3 =

TOPN ( 60, Fact_Table, Fact_Table[Date], DESC )

RETURN

SWITCH (

SELECTEDVALUE ( 'Table 1'[Date Period] ),

"1 Year",

STDEVX.S( tab1, [Portfolio A] )*SQRT(12),

"3 Year",

STDEVX.S( tab2, [Portfolio A] )*SQRT(12),

"5 Year",

STDEVX.S( tab3, [Portfolio A] )*SQRT(12)

)Information Ratio_A = IFERROR( [Portfolio_A]/[Tracking error A],"")Result is as follows nad there may be some Accuracy errors

Please check my attached pbix file for more details.

Best Regards,

Community Support Team _ Eason

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-easonf-msft thanks for getting back to me.

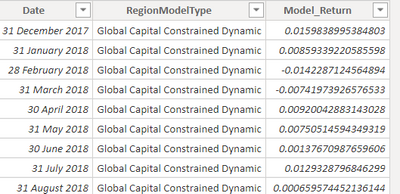

Model_Return is refering to the table where I have presented the headers, the data stream within it is simple what is in Portfolio A/Portfolio B, below is a small screenshot - Regional Model Type is the portfolio type; example data shows the below example which could be considered Portfolio A, there are quite a few others which my slicer will adjust for as the analytics require it. I only included A & B as an example.

=IFERROR(PRODUCT(1+B2:B13)-1,"") in this formula "B" is the return stream of Portfolio A/B (depending on which is being looked at) and each formula adjusted for the 1Y (12 data points) 3Y (36 data poitns) and 5Y (60 data points).

=STDEV(B2:B13)*SQRT(12) Same for this

=IFERROR(F3/F8,"") here you ask about "F" which is the above to results F3 = Portfolio performance, F8 = Tracking Error.

As for expected results - the table where I have populated the formulas show the expected outputs for Portfolio A in the Excel table.

Apologies for the confusion - hope the above helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, @JamesB86

Try formula as below:

calculated table:

Table 1 = DATATABLE("Date Period",STRING,{{"1 Year"},{"3 Year"},{"5 Year"}})Measure:

Portfolio_A =

VAR tab1 =

TOPN ( 12, Fact_Table, Fact_Table[Date], DESC )

VAR tab2 =

TOPN ( 36, Fact_Table, Fact_Table[Date], DESC )

VAR tab3 =

TOPN ( 60, Fact_Table, Fact_Table[Date], DESC )

VAR PortfolioA =

SWITCH (

SELECTEDVALUE ( 'Table 1'[Date Period] ),

"1 Year",

PRODUCTX ( tab1, 1 + [Portfolio A] ) - 1,

"3 Year",

PRODUCTX ( tab2, 1 + [Portfolio A] ) ^ ( 1 / 3 ) - 1,

"5 Year",

PRODUCTX ( tab3, 1 + [Portfolio A] ) ^ ( 1 / 5 ) - 1

)

RETURN

IFERROR ( PortfolioA, "" )Tracking error A =

VAR tab1 =

TOPN ( 12, Fact_Table, Fact_Table[Date], DESC )

VAR tab2 =

TOPN ( 36, Fact_Table, Fact_Table[Date], DESC )

VAR tab3 =

TOPN ( 60, Fact_Table, Fact_Table[Date], DESC )

RETURN

SWITCH (

SELECTEDVALUE ( 'Table 1'[Date Period] ),

"1 Year",

STDEVX.S( tab1, [Portfolio A] )*SQRT(12),

"3 Year",

STDEVX.S( tab2, [Portfolio A] )*SQRT(12),

"5 Year",

STDEVX.S( tab3, [Portfolio A] )*SQRT(12)

)Information Ratio_A = IFERROR( [Portfolio_A]/[Tracking error A],"")Result is as follows nad there may be some Accuracy errors

Please check my attached pbix file for more details.

Best Regards,

Community Support Team _ Eason

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Just a big thank you for supplying this - works perfectly with my visualisations providing matching results. Is it possible you could explain a bit more about what is happening within the solution? Just so I can get to grips with it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, @JamesB86

The variable 'tab1'/‘tab2’/'tab3' is a temporary table (data of the previous 12/36/60 months in descending order of Date).

The variable 'PortfolioA' is calculated based on the value of the Date Period of the current row.

If Date Period is "1 year", it will execut

PRODUCTX(tab1, 1 + [Portfolio A])-1If Date Period is "3 year", it will execut

PRODUCTX(tab2, 1 + [Portfolio A]) ^ (1/3)-1.If Date Period is "5 year", it will execut

PRODUCTX(tab3, 1 + [Portfolio A]) ^ (1/5)-1.

related function:

Best Regards,

Community Support Team _ Eason

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, @JamesB86

Sorry, I am still a bit confused about the information you provided. .

Which column in the data table does Master_Table[Model_Return] correspond to?

What does Column F in excel refer to (can you show relevant screenshots)? It would be great if you can show relevant desired results.

Best Regards,

Community Support Team _ Eason

Helpful resources

Power BI Dataviz World Championships

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now!

| User | Count |

|---|---|

| 41 | |

| 38 | |

| 36 | |

| 30 | |

| 28 |

| User | Count |

|---|---|

| 128 | |

| 88 | |

| 79 | |

| 67 | |

| 62 |