FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Vote for your favorite vizzies from the Power BI Dataviz World Championship submissions. Vote now!

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Moving Average Calculation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving Average Calculation

Hi,

I am trying to calculate moving Average for the below data:

Could someone help me with the DAX code for this calculation?

Thanks

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous ,

Yes and no. Since you are asking about 50 and 200 day moving averages, I'm going to assume you are talking about stock data. Since stocks dont trade everyday, we cannot use simple calculations like DatesInPeriod because that will look at all the dates in the period even weekends and such. So a 50 day moving average might really be just, say, 45. so we need to use something else besides the date.

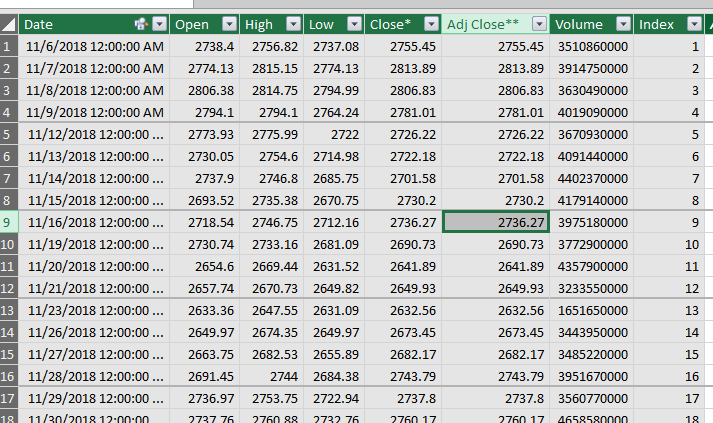

I loaded some sample S&P data into Power Query, sorted oldest to newest, and added an new Index column. This will be what we use for our start and end parameters. Much easier to see in the file. If it asks when you open, I just grabbed some data from yahoo.

Anyhow, with all that loaded, our table looks like:

Then we can write this measure:

50 Day Average:=

Var __Length= 50

Var __CurrentIndex = MAX ( FactDailyData[Index] )

Var __PrevIndex= __CurrentIndex - __Length

RETURN

If (__CurrentIndex >= __Length, //this ensures we only get an average after enough data points

AVERAGEX(

FILTER(

ALL ( FactDailyData),

__CurrentIndex>= FactDailyData[Index]

&&

__PrevIndex< FactDailyData[Index]

),

FactDailyData[Close*])

)This works as is since there's only one stock/index. If there was more would have to add in something to the filters likes __CurrentStock = FactDailyData[Stock]. Just something to keep in mind.

Not a huge fan of filtering this table, so this maybe something better as a calculated column (done in power query or dax) or a dimension table with index and stock, or something along those lines. But this method works:

Final Table:

Here's the file:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I thought I answered it here @sv11 @Anonymous

https://community.powerbi.com/t5/Desktop/Moving-Avg-Calculation/m-p/659236#M316557

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you have a dedicated Date/Calendar Table? If so, does it contain some sort of WeekNumber?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous

I had some issue logging in to my old profile, hence had to create a new one.

To answer your question, No i donot have a dedicated Date/Calendar Table.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

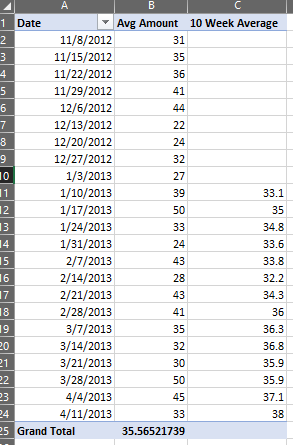

Here's the final table, will explain more below. Excel file is also attached

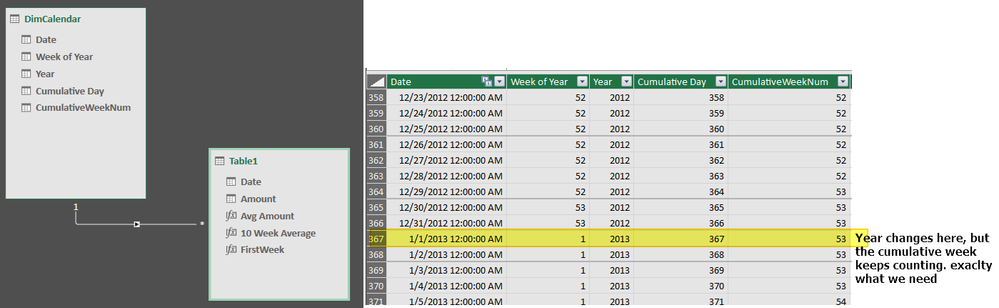

First thing was to create a Date table, which then would have a field for the cumulative week number of the calender since the average could cross years, so couldnt use just a simple week number. We relate that to the fact table and will use columns from the DimCalendar table for our filters:

Then from there it is using that column to build our measure:

Avg Amount:=AVERAGE( Table1[Amount] )

10 Week Average:=

//this ensures we dont get a figure till there is a enough data

VAR __FirstCumulativeWeek=

CALCULATE(

MIN( DimCalendar[CumulativeWeekNum]),

CALCULATETABLE(Table1,ALL(DimCalendar) )

)

RETURN

IF (

NOT (

ISBLANK( [Avg Amount])

),

CALCULATE( [Avg Amount],

FILTER(

ALL ( DimCalendar ),

MAX( DimCalendar[CumulativeWeekNum]) >= DimCalendar[CumulativeWeekNum]

&& MAX( DimCalendar[CumulativeWeekNum]) -10 < DimCalendar[CumulativeWeekNum]

&& MAX( DimCalendar[CumulativeWeekNum]) >= __FirstCumulativeWeek +9

)

)

)This all assumes there is just weekly data. If there is daily daily, we would need to sum that up to get the weekly total and then take an average of that. But that gets a little more involved.

Hope this helps

Here's the excel file:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous Thanks for the detailed response. This really helps.

I am trying to calculate a 50 day and 200 day Moving average on similar data with daily values. Is there a easy modification to your provided solution to achieve this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous ,

Yes and no. Since you are asking about 50 and 200 day moving averages, I'm going to assume you are talking about stock data. Since stocks dont trade everyday, we cannot use simple calculations like DatesInPeriod because that will look at all the dates in the period even weekends and such. So a 50 day moving average might really be just, say, 45. so we need to use something else besides the date.

I loaded some sample S&P data into Power Query, sorted oldest to newest, and added an new Index column. This will be what we use for our start and end parameters. Much easier to see in the file. If it asks when you open, I just grabbed some data from yahoo.

Anyhow, with all that loaded, our table looks like:

Then we can write this measure:

50 Day Average:=

Var __Length= 50

Var __CurrentIndex = MAX ( FactDailyData[Index] )

Var __PrevIndex= __CurrentIndex - __Length

RETURN

If (__CurrentIndex >= __Length, //this ensures we only get an average after enough data points

AVERAGEX(

FILTER(

ALL ( FactDailyData),

__CurrentIndex>= FactDailyData[Index]

&&

__PrevIndex< FactDailyData[Index]

),

FactDailyData[Close*])

)This works as is since there's only one stock/index. If there was more would have to add in something to the filters likes __CurrentStock = FactDailyData[Stock]. Just something to keep in mind.

Not a huge fan of filtering this table, so this maybe something better as a calculated column (done in power query or dax) or a dimension table with index and stock, or something along those lines. But this method works:

Final Table:

Here's the file:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dear @Anonymous ,

Thank you for posting this Power BI query.

Dear Anonymous,

Thank you for answering it with the sample measure. Adapting your solution enabled me to solve the rolling average issue that I had been facing for 2-3 months before I was able to find this query thread.

Thank you both so much!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dear @Anonymous ,

Thank you for posting this Power BI query.

Dear Anonymous,

Thank you for answering it with the sample measure. Adapting your solution enabled me to solve the rolling average issue that I had been facing for 2-3 months before I was able to find this query thread.

Thank you both so much!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked for me with slight modification

original

===========

Var __CurrentIndex = MAX ( FactDailyData[Index] )

revised

Var __CurrentIndex = FactDailyData[Index]

Helpful resources

Power BI Dataviz World Championships

Vote for your favorite vizzies from the Power BI World Championship submissions!

Join our Community Sticker Challenge 2026

If you love stickers, then you will definitely want to check out our Community Sticker Challenge!

Power BI Monthly Update - January 2026

Check out the January 2026 Power BI update to learn about new features.

| User | Count |

|---|---|

| 55 | |

| 52 | |

| 41 | |

| 16 | |

| 16 |

| User | Count |

|---|---|

| 107 | |

| 104 | |

| 40 | |

| 33 | |

| 25 |