Join us at FabCon Vienna from September 15-18, 2025

The ultimate Fabric, Power BI, SQL, and AI community-led learning event. Save €200 with code FABCOMM.

Get registered- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- Quick Measures Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Compete to become Power BI Data Viz World Champion! First round ends August 18th. Get started.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- How to do sequential ranking in Power Bi

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do sequential ranking in Power Bi

Hi guys!

Does anyone could give me some advice on these two problems please?

1) I have different rankings for Assets, and I would like to apply them sequentially, like in the following example.

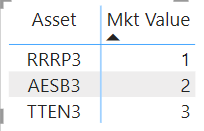

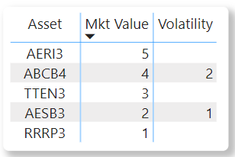

- I have 7 Asset Codes in my example database, and if I apply the Market Value ranking and limit my number of positions to the first 3 Assets (thus Asset Code number 1 is the one with the highest market value and so on), I'd get this:

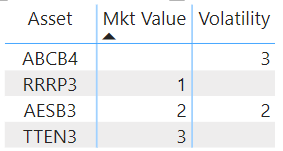

After If I apply the Volatility ranking (the ones with the lowest volatility values get the first positions), the expected result would be this:

Asset Rank Volatility

AESB3 1

TTEN3 2

RRRP3 3

If I simply put the rank volatility together with the first table, it returns me the rank considering more than these 3 Asset Codes, like this:

2) After, I would like to be able to restrain also the quantity of Asset Codes for the subsequent rankings, like this:

2.1) I choose to show the 6 first Asset Codes positions with the Market Value ranking;

2.2) And after I filter the 3 first Asset Codes positions with the Volatility ranking from these 6 prior Asset Codes.

Does anyone have an idea how it could be done?

Here is the example file: https://drive.google.com/file/d/1N_g1fl5zkXibp6vNwy9s_oBifJCiGu0n/view?usp=sharing

Thanks! 🙌

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ahh I discovered how to deal with the first one! I just applied a filter level on market value, in order for it to be bigger than zero, going from this:

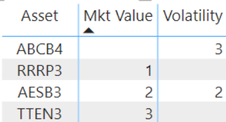

To this:

Now it's only the second problem left 😯

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

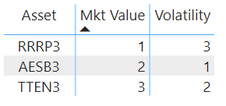

I discovered how to deal with the second one also 😄

For the second problem we have to create another table 'Top N' (which I named 'Top N 2'), and do the same measure that selects the ranking in function of these slicers ("Top N 2 Volatility"). Now we have two independent slicers, and the selections works in the same table:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I discovered how to deal with the second one also 😄

For the second problem we have to create another table 'Top N' (which I named 'Top N 2'), and do the same measure that selects the ranking in function of these slicers ("Top N 2 Volatility"). Now we have two independent slicers, and the selections works in the same table:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ahh I discovered how to deal with the first one! I just applied a filter level on market value, in order for it to be bigger than zero, going from this:

To this:

Now it's only the second problem left 😯