Join us at FabCon Vienna from September 15-18, 2025

The ultimate Fabric, Power BI, SQL, and AI community-led learning event. Save €200 with code FABCOMM.

Get registered- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- Quick Measures Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Enhance your career with this limited time 50% discount on Fabric and Power BI exams. Ends August 31st. Request your voucher.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- For the life of me, I can't understand why the tot...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

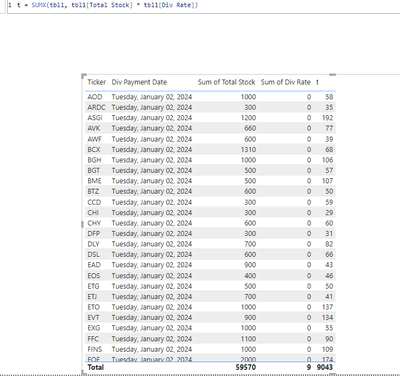

For the life of me, I can't understand why the total is WRONG

I have a Tickers table with the next dividend date and the rate. All good.

I have a measure that calculates the total stock for each Ticker. All good.

I've created a new measure that calcualates the forecast dividend. All good for each ticker, BUT,, the total is WAY OUT.!

I'm attaching the visual export. The estimates are correct for each stock and when I add them up in Excel, the total is corret but the BI Visual gives me a ridiculous figure (not sure where it's coming from) 58,974, when it should be 9,043.

What is wrong.

Here's the measure (it's simple and should give me the correct total)

attached is the visual export Div Est is correct here but

| Div Payment Date | Ticker | Div Est | Total Stock | Div Rate | Excel Check |

| 2/1/2024 | AOD | 57.5 | 1000 | 0.0575 | 57.5 |

| 2/1/2024 | ARDC | 35.25 | 300 | 0.1175 | 35.25 |

| 2/1/2024 | ASGI | 192 | 1200 | 0.16 | 192 |

| 2/1/2024 | AVK | 77.352 | 660 | 0.1172 | 77.352 |

| 2/1/2024 | AWF | 39.3 | 600 | 0.0655 | 39.3 |

| 2/1/2024 | BCX | 67.858 | 1310 | 0.0518 | 67.858 |

| 2/1/2024 | BGH | 105.6 | 1000 | 0.1056 | 105.6 |

| 2/1/2024 | BGT | 56.79 | 500 | 0.11358 | 56.79 |

| 2/1/2024 | BME | 106.5 | 500 | 0.213 | 106.5 |

| 2/1/2024 | BTZ | 50.34 | 600 | 0.0839 | 50.34 |

| 2/1/2024 | CCD | 58.5 | 300 | 0.195 | 58.5 |

| 2/1/2024 | CHI | 28.5 | 300 | 0.095 | 28.5 |

| 2/1/2024 | CHY | 60 | 600 | 0.1 | 60 |

| 2/1/2024 | DFP | 31.2 | 300 | 0.104 | 31.2 |

| 2/1/2024 | DLY | 81.69 | 700 | 0.1167 | 81.69 |

| 2/1/2024 | DSL | 66 | 600 | 0.11 | 66 |

| 2/1/2024 | EAD | 42.921 | 900 | 0.04769 | 42.921 |

| 2/1/2024 | EOS | 46.08 | 400 | 0.1152 | 46.08 |

| 2/1/2024 | ETG | 50.05 | 500 | 0.1001 | 50.05 |

| 2/1/2024 | ETJ | 40.53 | 700 | 0.0579 | 40.53 |

| 2/1/2024 | ETO | 137.4 | 1000 | 0.1374 | 137.4 |

| 2/1/2024 | EVT | 133.92 | 900 | 0.1488 | 133.92 |

| 2/1/2024 | EXG | 55.3 | 1000 | 0.0553 | 55.3 |

| 2/1/2024 | FFC | 89.65 | 1100 | 0.0815 | 89.65 |

| 2/1/2024 | FINS | 109 | 1000 | 0.109 | 109 |

| 2/1/2024 | FOF | 174 | 2000 | 0.087 | 174 |

| 2/1/2024 | FRA | 58.51 | 500 | 0.11702 | 58.51 |

| 2/1/2024 | FSD | 115.5 | 1100 | 0.105 | 115.5 |

| 2/1/2024 | FSK | 40 | 800 | 0.05 | 40 |

| 2/1/2024 | GHY | 115.5 | 1100 | 0.105 | 115.5 |

| 2/1/2024 | HPI | 61.75 | 500 | 0.1235 | 61.75 |

| 2/1/2024 | HTD | 165.6 | 1200 | 0.138 | 165.6 |

| 2/1/2024 | HYT | 116.85 | 1500 | 0.0779 | 116.85 |

| 2/1/2024 | IFN | 1189 | 2900 | 0.41 | 1189 |

| 2/1/2024 | IGR | 210 | 3500 | 0.06 | 210 |

| 2/1/2024 | JEPI | 90.183 | 300 | 0.30061 | 90.183 |

| 2/1/2024 | JPC | 50.28 | 1200 | 0.0419 | 50.28 |

| 2/1/2024 | JRI | 78.3 | 900 | 0.087 | 78.3 |

| 2/1/2024 | KIO | 109.35 | 900 | 0.1215 | 109.35 |

| 2/1/2024 | KMI | 480.25 | 1700 | 0.2825 | 480.25 |

| 2/1/2024 | LDP | 104.8 | 800 | 0.131 | 104.8 |

| 2/1/2024 | LGI | 115.049 | 1100 | 0.10459 | 115.049 |

| 2/1/2024 | LNC | 135 | 300 | 0.45 | 135 |

| 2/1/2024 | MAIN | 192 | 800 | 0.24 | 192 |

| 2/1/2024 | MEGI | 100 | 800 | 0.125 | 100 |

| 2/1/2024 | O | 76.95 | 300 | 0.2565 | 76.95 |

| 2/1/2024 | OKE | 1336.5 | 1350 | 0.99 | 1336.5 |

| 2/1/2024 | PFFA | 159.125 | 950 | 0.1675 | 159.125 |

| 2/1/2024 | PSF | 100.8 | 800 | 0.126 | 100.8 |

| 2/1/2024 | PTA | 120.6 | 900 | 0.134 | 120.6 |

| 2/1/2024 | RFI | 80 | 1000 | 0.08 | 80 |

| 2/1/2024 | RLTY | 110 | 1000 | 0.11 | 110 |

| 2/1/2024 | RNP | 190.4 | 1400 | 0.136 | 190.4 |

| 2/1/2024 | RQI | 200 | 2500 | 0.08 | 200 |

| 2/1/2024 | SPE | 43.35 | 500 | 0.0867 | 43.35 |

| 2/1/2024 | STAG | 147.996 | 1200 | 0.12333 | 147.996 |

| 2/1/2024 | THQ | 168.75 | 1500 | 0.1125 | 168.75 |

| 2/1/2024 | THW | 175.05 | 1500 | 0.1167 | 175.05 |

| 2/1/2024 | UNM | 255.5 | 700 | 0.365 | 255.5 |

| 2/1/2024 | UTF | 186 | 1200 | 0.155 | 186 |

| 2/1/2024 | UTG | 171 | 900 | 0.19 | 171 |

| 9043.174 | 9043.174 |

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OUTPUT

t = SUMX(tbl1, tbl1[Total Stock] * tbl1[Div Rate])

If my answer helped sort things out for you, i would appreciate a thumbs up 👍 and mark it as the solution ✅

It makes a difference and might help someone else too. Thanks for spreading the good vibes! 🤠

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi. I did in the message but I've SOLVED it. The measure should be Sumx([Total Stock]*[Tickers[Div Rate] NOT max(Tickers[Div Rate]! Stupid of me! Thanks for helping out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi. I did in the message but I've SOLVED it. The measure should be Sumx([Total Stock]*[Tickers[Div Rate] NOT max(Tickers[Div Rate]! Stupid of me! Thanks for helping out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OUTPUT

t = SUMX(tbl1, tbl1[Total Stock] * tbl1[Div Rate])

If my answer helped sort things out for you, i would appreciate a thumbs up 👍 and mark it as the solution ✅

It makes a difference and might help someone else too. Thanks for spreading the good vibes! 🤠

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

can you please the sample data .

How to provide sample data in the Power BI Forum

https://community.fabric.microsoft.com/t5/Community-Blog/How-to-provide-sample-data-in-the-Power-BI-...

How to Get Your Question Answered Quickly

https://community.fabric.microsoft.com/t5/Desktop/How-to-Get-Your-Question-Answered-Quickly/m-p/1447...

Helpful resources

| User | Count |

|---|---|

| 77 | |

| 75 | |

| 36 | |

| 31 | |

| 28 |

| User | Count |

|---|---|

| 95 | |

| 81 | |

| 55 | |

| 48 | |

| 48 |