Fabric Data Days starts November 4th!

Advance your Data & AI career with 50 days of live learning, dataviz contests, hands-on challenges, study groups & certifications and more!

Get registered- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Get Fabric Certified for FREE during Fabric Data Days. Don't miss your chance! Learn more

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Cumulative product - Index base 100 dynamic ba...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cumulative product - Index base 100 dynamic base

Hello everybody,

I kindly ask for someone's help to solve the following:

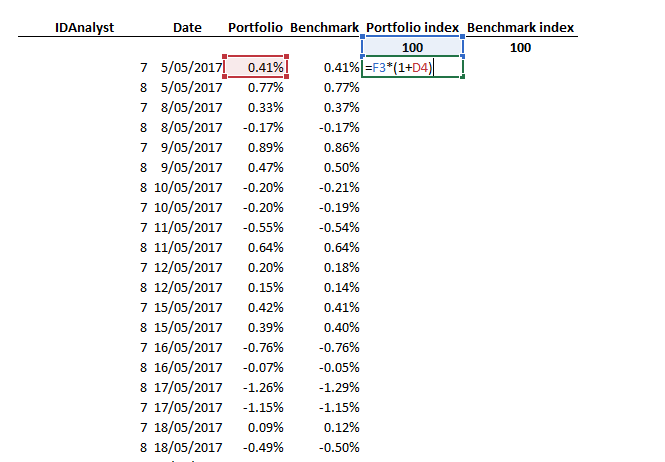

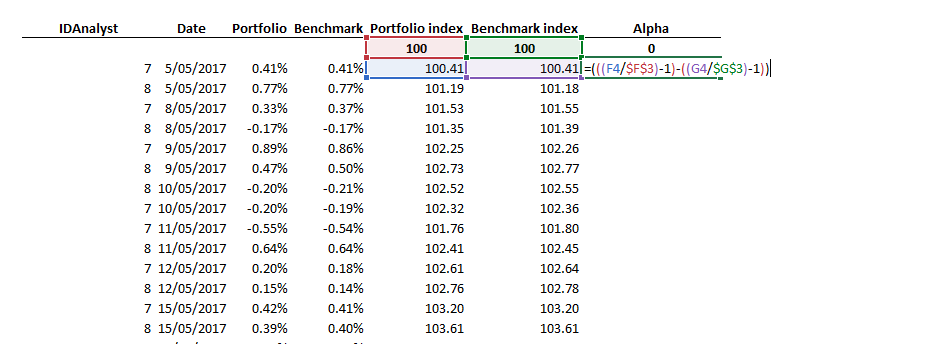

I have a table with four columns: IDAnalyst, Date, Portfolio (return) and Benchmark (return). I have to calculate three additional measures. An index base 100 for each portfolio and benchmark columns with a dynamic base and with the possibility to be filtered by analyst with a slicer (as well as by initial date and end date). Additionally, I have to calculate the cumulative alpha (difference between portfolio and benchmark returns: Portfolio - Benchmark). There is no date for every calendar year's dates in the Dates column. Please find attached two screenshots with an example of how I am doing it in excel.

Thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

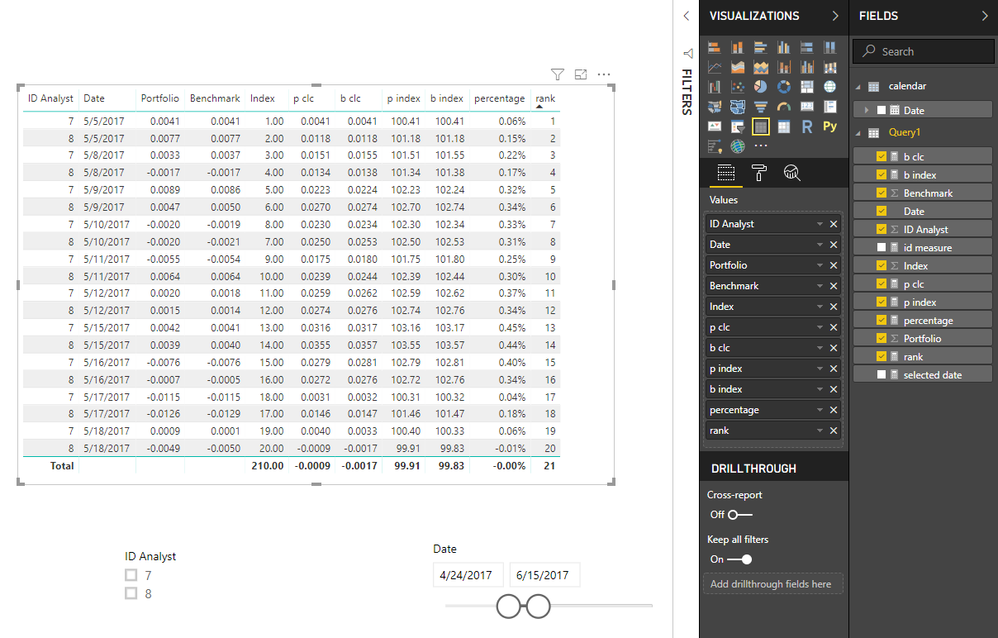

1.Create a calendar date table, create correct relationship(one to many, both direction) between two tables, add date from this table in the slicer.

calendar = CALENDARAUTO()

2. open edit queries, keep the order as your screenshot, then add an index column,

close&&apply

3.create measures in your main table

selected date = MAX(Query1[Date]) p clc = CALCULATE(SUM(Query1[Portfolio]),FILTER(ALLSELECTED(Query1),Query1[Index]<=MAX(Query1[Index]))) p index = IF([selected date]=BLANK(),BLANK(),100*(1+[p clc])) b clc = CALCULATE(SUM(Query1[Benchmark]),FILTER(ALLSELECTED(Query1),Query1[Index]<=MAX(Query1[Index]))) b index = IF([selected date]=BLANK(),BLANK(),100*(1+[b clc])) percentage = [p clc]/[id measure]

Best Regards

Maggie

Community Support Team _ Maggie Li

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-juanli-msft,

To which measure are you referring to with [id measure] in the percentage measure?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

I really apologize for missing your email before.

When you open my file, you will see

id measure = SUM(Query1[ID Analyst])

Best Regards

Maggie

Community Support Team _ Maggie Li

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-juanli-msft,

Thank you for answering. I am still having trouble with the results. As you can see, I did the same exercise in Excel with the same numbers as you did in the attached file for analyst 7 and the results are not the same. This may seem like a small difference, but when you compound the results it amounts for a lot. Please find attached an image with the example.

Best regards,

Juan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

"each portfolio and benchmark columns with a dynamic base and with the possibility to be filtered by analyst with a slicer (as well as by initial date and end date)"

Could you show an example how the portfolio index and benchmark index should change with the date slicer?

I can go to Edit queries to add custom columns and do some transformation to get the table as yours.

But it is static finally.

Best Regards

Maggie

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello @v-juanli-msft ,

Thank you for answering. Let's say for example I have data ranging from 01/01/2017 to today. Initially, if I make the calculation from 01/01/2017, I would start with a base of 100, and it would change sequentially with each new portfolio/benchmark return. But, I would like to be able to use a slicer to make the calculation, say, for example, since 01/01/2018. Then, the base of 100 would start on that date and change sequentially. As I have returns for as many number of analysts I have in my database, and each analyst's portfolio and benchmark is independent from each other, I would like to be able to filter by analyst as well. So one analyst may exist in the database since 01/01/2017, and another since 01/06/2018. Then, if I filter by analyst, the benchmark and portfolio indexes, as well as the alpha will be calculated specifically for that analyst in the range of dates filtered as well, starting with base 100 in the initial date.

These two filters, analyst and date, I would like to apply in the calculation of the benchmark and portfolio indexes and subsequently the alpha, which is simply the difference between both.

What I can see from your example though, is that the index is not being calculated in a cumulative way.

Best regards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@amitchandak I am having same above requirement, can you please help me on the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

Is this problem sloved?

If it is sloved, could you kindly accept it as a solution to close this case?

If not, please let me know.

Best Regards

Maggie

Helpful resources

Fabric Data Days

Advance your Data & AI career with 50 days of live learning, contests, hands-on challenges, study groups & certifications and more!

Power BI Monthly Update - October 2025

Check out the October 2025 Power BI update to learn about new features.