FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Get Fabric Certified for FREE during Fabric Data Days. Don't miss your chance! Request now

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Correlation between same column, different ite...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correlation between same column, different items for time periods

Afternoon,

I'm trying to find the correlation between the [close] column values of the 'StockbarDataExample' table for different companies in the 'StockSymbolExchangeCode' column.

I'm not sure how to compare the two time series given they share the same column for values.

Pbix & Source Link: https://1drv.ms/f/s!At8Q-ZbRnAj8iF5lSSIdn2oi2tGj

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In this sort of "pairwise comparison" scenario, where you have multiple entities in the same table (in this case distinguished by StockSymbolCurrency) I would normally follow the below steps.

My modifed copy of your pbix is here:

https://www.dropbox.com/s/y9h2ncitj46ee6a/PowerBiForumExample2%20Owen%20edit.pbix?dl=0

- Create a copy of the entity dimension table, in your case a copy of ReferenceTable which I would call ReferenceTableComparison

- Create a relationship between StockBarDatExample and ReferenceTableComparison, but make it inactive

- Create the appropriate value measure that will be used for the company selected in ReferenceTable. For testing purposes I created

Average Close = AVERAGE ( StockBarDatExample[close] )

- Create the same measure for the Comparison Company, which activates the inactive relationship, and clears the filter on ReferenceTable:

Average Close Comparison = CALCULATE ( [Average Close], ALL ( ReferenceTable ), USERELATIONSHIP ( StockBarDatExample[StockSymbolCurrency], ReferenceTableComparison[StockSymbolCurrency] ) ) - You can then selected Company & Comparison Company using slicers, and use Average Close & Average Close Comparison together in visuals.

- The Pearson Correlation Coefficient can be calculated using a method similar to that used here. This relies on having the above two measures set up.

Here is the measure I tested with your data:Pearson Correlation Coefficient = VAR DateTimes = // Create a table of date/times where both stocks have a Close value FILTER ( SUMMARIZE ( StockBarDatExample, DateTable[DateKey], TimeTable[Column1] ), // Date & Time columns AND ( NOT ( ISBLANK ( [Average Close] ) ), NOT ( ISBLANK ( [Average Close Comparison] ) ) ) ) // Construct table of pairs of Close values VAR Known = SELECTCOLUMNS ( DateTimes, "Known[X]", [Average Close], "Known[Y]", [Average Close Comparison] ) // Calculate correlation coefficient VAR Count_Items = COUNTROWS ( Known ) VAR Average_X = AVERAGEX ( Known, Known[X] ) VAR Average_X2 = AVERAGEX ( Known, Known[X] ^ 2 ) VAR Average_Y = AVERAGEX ( Known, Known[Y] ) VAR Average_Y2 = AVERAGEX ( Known, Known[Y] ^ 2 ) VAR Average_XY = AVERAGEX ( Known, Known[X] * Known[Y] ) VAR CorrelationCoefficient = DIVIDE ( Average_XY - Average_X * Average_Y, SQRT ( ( Average_X2 - Average_X ^ 2 ) * ( Average_Y2 - Average_Y ^ 2 ) ) ) RETURN CorrelationCoefficient

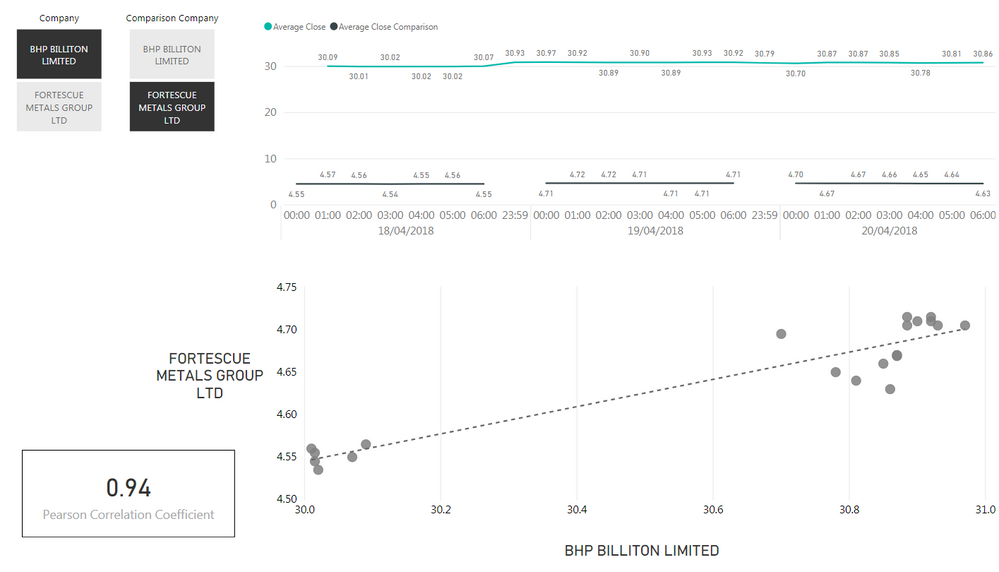

The test report page in the above pbix looks like this:

Hopefully that helps. 🙂

Regards,

Owen

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HI @ElliotP,

You can use below formula to get diff between two legend:

Diff =

VAR c1 =

FIRSTNONBLANK ( ALL ( ReferenceTable[CompanyName] ), [CompanyName] )

VAR c2 =

LASTNONBLANK ( ALL ( ReferenceTable[CompanyName] ), [CompanyName] )

RETURN

ABS (

CALCULATE (

SUM ( StockBarDatExample[close] ),

ReferenceTable[CompanyName] = c1

)

- CALCULATE (

SUM ( StockBarDatExample[close] ),

ReferenceTable[CompanyName] = c2

)

)

AFAIK, current line chart not support use multiple value field and legend at same time, I'd like to suggest you use 'line and clustered column chart' to instead.

Regards,

Xiaoxin Sheng

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@AnonymousThanks for the response.

I'm not trying to calculate the difference between the different company's closes, but I think the principles might be able to work. I would like to be able to calculate the correlation between the time series data for each company; but I'm unable to at the moment as both time series values are in the same column ([close]), but they two time series are distinguishable by the 'StockSymbolCurrency' column string value.

The idea of using variables to seperate the time series values before returning a correlation figure is interesting, but I'm not sure how to get each variable to filter over subsequent different string values in the 'StockSymbolCurrency' column.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In this sort of "pairwise comparison" scenario, where you have multiple entities in the same table (in this case distinguished by StockSymbolCurrency) I would normally follow the below steps.

My modifed copy of your pbix is here:

https://www.dropbox.com/s/y9h2ncitj46ee6a/PowerBiForumExample2%20Owen%20edit.pbix?dl=0

- Create a copy of the entity dimension table, in your case a copy of ReferenceTable which I would call ReferenceTableComparison

- Create a relationship between StockBarDatExample and ReferenceTableComparison, but make it inactive

- Create the appropriate value measure that will be used for the company selected in ReferenceTable. For testing purposes I created

Average Close = AVERAGE ( StockBarDatExample[close] )

- Create the same measure for the Comparison Company, which activates the inactive relationship, and clears the filter on ReferenceTable:

Average Close Comparison = CALCULATE ( [Average Close], ALL ( ReferenceTable ), USERELATIONSHIP ( StockBarDatExample[StockSymbolCurrency], ReferenceTableComparison[StockSymbolCurrency] ) ) - You can then selected Company & Comparison Company using slicers, and use Average Close & Average Close Comparison together in visuals.

- The Pearson Correlation Coefficient can be calculated using a method similar to that used here. This relies on having the above two measures set up.

Here is the measure I tested with your data:Pearson Correlation Coefficient = VAR DateTimes = // Create a table of date/times where both stocks have a Close value FILTER ( SUMMARIZE ( StockBarDatExample, DateTable[DateKey], TimeTable[Column1] ), // Date & Time columns AND ( NOT ( ISBLANK ( [Average Close] ) ), NOT ( ISBLANK ( [Average Close Comparison] ) ) ) ) // Construct table of pairs of Close values VAR Known = SELECTCOLUMNS ( DateTimes, "Known[X]", [Average Close], "Known[Y]", [Average Close Comparison] ) // Calculate correlation coefficient VAR Count_Items = COUNTROWS ( Known ) VAR Average_X = AVERAGEX ( Known, Known[X] ) VAR Average_X2 = AVERAGEX ( Known, Known[X] ^ 2 ) VAR Average_Y = AVERAGEX ( Known, Known[Y] ) VAR Average_Y2 = AVERAGEX ( Known, Known[Y] ^ 2 ) VAR Average_XY = AVERAGEX ( Known, Known[X] * Known[Y] ) VAR CorrelationCoefficient = DIVIDE ( Average_XY - Average_X * Average_Y, SQRT ( ( Average_X2 - Average_X ^ 2 ) * ( Average_Y2 - Average_Y ^ 2 ) ) ) RETURN CorrelationCoefficient

The test report page in the above pbix looks like this:

Hopefully that helps. 🙂

Regards,

Owen

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @OwenAuger,

Thank you for posting this dashboard!

I am trying to do something similar with multiple stocks. Your appraoch looks promising however I think the result you are getting is not correct in your example I believe the correlation should be 0.97714 instead of 0.94. It seems to be linked to the issue discussed in this thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks for your reply on this topic 🙂

My original reply created a measure that calculation the correlation coefficient based only on records where X and Y are both nonblank.

With that assumption, I believe the correlation coefficient of 0.94 is correct (can be tested by pasting data to Excel, removing rows where either X or Y is blank, and applying the CORREL function).

For your particular case, I'm not sure where the calculation is going wrong. It could possibly relate to how the Known table is constructed. Known should include only the rows to be included in the correlation coefficient calculation.

Could you post some more detail, even dummy data in a PBIX that illustrates when the calculation doesn't produce the expected result?

Regards,

Owen

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@OwenAugerThank you so much, that's amazing.

As an extension, from an idea, would it be possible to do this for a large number of comparisions? I get the feeling that might be better done with python and then exploring the resultant table and data from that instead of trying to use a tabular model to achieve that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

You're welcome 🙂

There's nothing to stop you having an arbitrary number of stocks in your source table...and you could use a matrix visual to show the correlation of every combination, or use that Correlation Plot custom visual. Or create your own R visual I guess

Perhaps performance might be better if you prepare the data with python (or R?) rather than computing on the fly - though don't have much experience with that myself.

Helpful resources

Power BI Monthly Update - November 2025

Check out the November 2025 Power BI update to learn about new features.

Fabric Data Days

Advance your Data & AI career with 50 days of live learning, contests, hands-on challenges, study groups & certifications and more!