FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now! Learn more

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Help avoiding a circular dependency in a measure

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help avoiding a circular dependency in a measure

I am trying to figure out how to build these measures while avoiding a circular dependency. I cannot use a calculated column due to the nature of the report. The only table that exists in the dataset is a one column table for Age that has ages 10-100 listed.

This is what I am going for

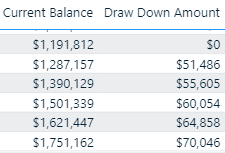

Currently I have a Current Balance field that is being calculated as growing 8% every year and a Draw Down amount that is just Current Balance * .04

How can I get the Current Balance measure to subtract the Draw Down Amount and then recalculate the 8% increase based on that new balance?

The formula that I have for Current Balance is this (thanks to SQLBI)

VAR SelectedYear =

SELECTEDVALUE (

'Age'[Age], -- Find the current year in the report

MAX ( 'Age'[Age] ) -- default to the last year available

)

VAR PreviousYears = -- PreviousYears contains the

FILTER ( -- years BEFORE the current one

ALL ( 'Age'[Age] ),

'Age'[Age] <= SelectedYear

)

VAR PreviousInvestments = -- PreviousInvestments contains

ADDCOLUMNS ( -- the amount of all the investments

PreviousYears, -- made in previous years

"@InvestedAmt", CALCULATE (

--SUM ( Investments[Amount] )

[Annual Contribution]

)

)

VAR Result = -- For each previous investment

SUMX ( -- calculate the compound interest

PreviousInvestments, -- over the years and sum the results

VAR InvestmentYear = 'Age'[Age]

VAR InvestmentAmt = [@InvestedAmt]

VAR YearsRateActive =

FILTER (

ALL ( 'Age' ),

VAR YearRate = 'Age'[Age]

RETURN

YearRate >= InvestmentYear

&& YearRate <= SelectedYear

)

VAR CompundInterestRateForInvestment =

PRODUCTX (

YearsRateActive,

1 + 'Annual Return'[Annual Return Value]

--Rates[InterestRate]

)

RETURN

InvestmentAmt * CompundInterestRateForInvestment

)

RETURN

Result

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Subtracting 4% is the same as multiplying by 0.96 and adding 8% to that amount is the same as multiplying by 1.08.

EndOfYear balance = StartOfYearBalance * 0.96 * 1.08 = StartOfYearBalance * 1.0368

So, your real annual return is 3.68%.

Try updating your measure to take out the 4% in this variable:

VAR CompundInterestRateForInvestment =

PRODUCTX ( YearsRateActive, 1 + 0.96 * [Annual Return Value] )- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Subtracting 4% is the same as multiplying by 0.96 and adding 8% to that amount is the same as multiplying by 1.08.

EndOfYear balance = StartOfYearBalance * 0.96 * 1.08 = StartOfYearBalance * 1.0368

So, your real annual return is 3.68%.

Try updating your measure to take out the 4% in this variable:

VAR CompundInterestRateForInvestment =

PRODUCTX ( YearsRateActive, 1 + 0.96 * [Annual Return Value] )- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@AlexisOlson While this wasn't the exact solution I needed to implement to get it to work, this helped me think about it in a different way and got my on the right track. Thank you for the help!

Helpful resources

Power BI Dataviz World Championships

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now!

| User | Count |

|---|---|

| 19 | |

| 13 | |

| 8 | |

| 4 | |

| 4 |

| User | Count |

|---|---|

| 29 | |

| 21 | |

| 17 | |

| 11 | |

| 10 |