Join us at the 2025 Microsoft Fabric Community Conference

Microsoft Fabric Community Conference 2025, March 31 - April 2, Las Vegas, Nevada. Use code FABINSIDER for a $400 discount.

Register now- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Webinars and Video Gallery

- Data Stories Gallery

- Themes Gallery

- Power BI DataViz World Championships Gallery

- Quick Measures Gallery

- R Script Showcase

- COVID-19 Data Stories Gallery

- Community Connections & How-To Videos

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI DataViz World Championships are on! With four chances to enter, you could win a spot in the LIVE Grand Finale in Las Vegas. Show off your skills.

- Power BI forums

- Galleries

- Quick Measures Gallery

- Re: F.DIST

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

F.DIST

In my recent quest to create or catalog as many DAX equivalents for Excel functions was able to leverage my work on GAMMA to come up with F.DIST.

F.THIS =

VAR __x = [x]

VAR __Deg1 = [Deg_freedom1]

VAR __Deg2 = [Deg_freedom2]

VAR __GAMMA1 =

VAR __zInput = (__Deg2 + __Deg1) / 2

VAR __p =

{

(0, 676.5203681218851),

(1, -1259.1392167224028),

(2, 771.32342877765313),

(3, -176.61502916214059),

(4, 12.507343278686905),

(5, -0.13857109526572012),

(6, 9.9843695780195716e-6),

(7, 1.5056327351493116e-7)

}

VAR __EPSILON = 1e-7

VAR __z = IF(__zInput < 0.5, 1 - __zInput - 1,__zInput - 1)

VAR __pTable =

ADDCOLUMNS(

__p,

"x",[Value2] / (__z + [Value1] + 1)

)

VAR __x = 0.99999999999980993 + SUMX(__pTable,[x])

VAR __t = __z + COUNTROWS(__pTable) - .5

VAR __y =

IF(

__zInput < 0.5,

PI() / (SIN(PI() * __zInput) * SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x),

SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x

)

RETURN

__y

VAR __GAMMA2 =

VAR __zInput = (__Deg1) / 2

VAR __p =

{

(0, 676.5203681218851),

(1, -1259.1392167224028),

(2, 771.32342877765313),

(3, -176.61502916214059),

(4, 12.507343278686905),

(5, -0.13857109526572012),

(6, 9.9843695780195716e-6),

(7, 1.5056327351493116e-7)

}

VAR __EPSILON = 1e-7

VAR __z = IF(__zInput < 0.5, 1 - __zInput - 1,__zInput - 1)

VAR __pTable =

ADDCOLUMNS(

__p,

"x",[Value2] / (__z + [Value1] + 1)

)

VAR __x = 0.99999999999980993 + SUMX(__pTable,[x])

VAR __t = __z + COUNTROWS(__pTable) - .5

VAR __y =

IF(

__zInput < 0.5,

PI() / (SIN(PI() * __zInput) * SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x),

SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x

)

RETURN

__y

VAR __GAMMA3 =

VAR __zInput = (__Deg2) / 2

VAR __p =

{

(0, 676.5203681218851),

(1, -1259.1392167224028),

(2, 771.32342877765313),

(3, -176.61502916214059),

(4, 12.507343278686905),

(5, -0.13857109526572012),

(6, 9.9843695780195716e-6),

(7, 1.5056327351493116e-7)

}

VAR __EPSILON = 1e-7

VAR __z = IF(__zInput < 0.5, 1 - __zInput - 1,__zInput - 1)

VAR __pTable =

ADDCOLUMNS(

__p,

"x",[Value2] / (__z + [Value1] + 1)

)

VAR __x = 0.99999999999980993 + SUMX(__pTable,[x])

VAR __t = __z + COUNTROWS(__pTable) - .5

VAR __y =

IF(

__zInput < 0.5,

PI() / (SIN(PI() * __zInput) * SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x),

SQRT(2*PI()) * POWER(__t,__z+0.5) * EXP(-1*__t) * __x

)

RETURN

__y

RETURN

DIVIDE(__GAMMA1,__GAMMA2 * __GAMMA3) *

POWER(__Deg1/__Deg2,__Deg1/2) *

DIVIDE(

POWER(__x,(__Deg1-2)/2),

POWER(1+(__Deg1/__Deg2)*__x,(__Deg1+__Deg2)/2)

)

The cumulative form of F.DIST is:

F.THIS.CUMULATIVE =

VAR __x = [x]

VAR __df1 = [Deg_freedom1]

VAR __df2 = [Deg_freedom2]

RETURN

BETA.DIST(

__x*__df1/(__x*__df1+__df2),

__df1/2,

__df2/2,

TRUE

)F.DIST.RT is:

F.THIS.RT = 1 - [F.THIS.CUMULATIVE]F.INV is this:

F.INV =

VAR __p = [F.THIS.CUMULATIVE]

VAR __df1 = [Deg_freedom1]

VAR __df2 = [Deg_freedom2]

RETURN

BETA.INV(__p,__df1/2,__df2/2) * __df2/(__df1*(1-BETA.INV(__p,__df1/2,__df2/2)))

And last but not least, F.INV.RT:

F.INV.RT =

VAR __p = 1 - [F.THIS.RT]

VAR __df1 = [Deg_freedom1]

VAR __df2 = [Deg_freedom2]

RETURN

BETA.INV(__p,__df1/2,__df2/2) * __df2/(__df1*(1-BETA.INV(__p,__df1/2,__df2/2)))Thank goodness for actual documentation:

- https://support.minitab.com/en-us/minitab-express/1/help-and-how-to/basic-statistics/probability-dis...

- http://www.real-statistics.com/chi-square-and-f-distributions/f-distribution/

eyJrIjoiOGRlZDc0OTUtMjE3MC00Mjg4LTgxZTktMDEzMDkxNzEzZjUxIiwidCI6IjRhMDQyNzQzLTM3M2EtNDNkMi04MjdiLTAwM2Y0YzdiYTFlNSIsImMiOjN9

Follow on LinkedIn

@ me in replies or I'll lose your thread!!!

Instead of a Kudo, please vote for this idea

Become an expert!: Enterprise DNA

External Tools: MSHGQM

YouTube Channel!: Microsoft Hates Greg

Latest book!: Power BI Cookbook Third Edition (Color)

DAX is easy, CALCULATE makes DAX hard...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

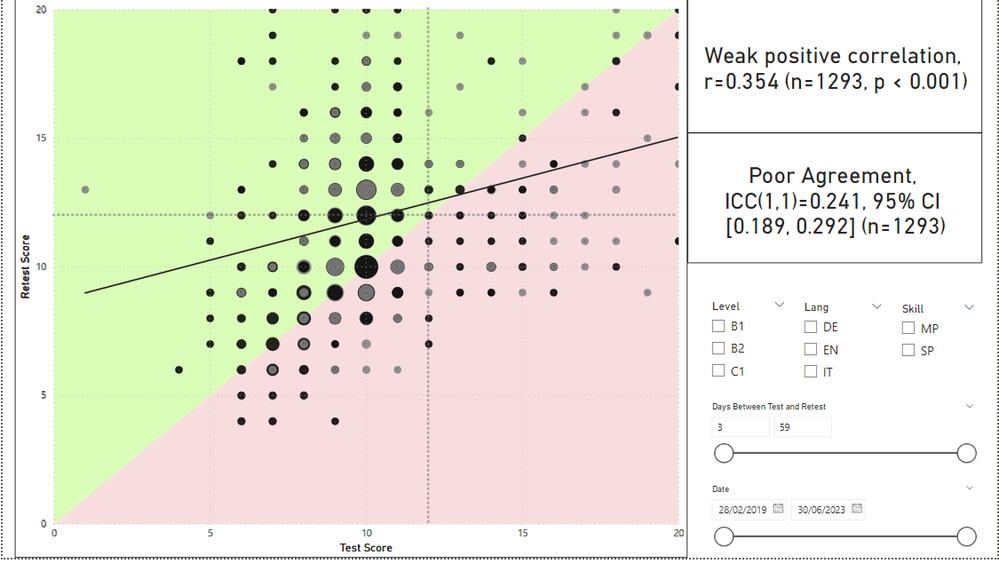

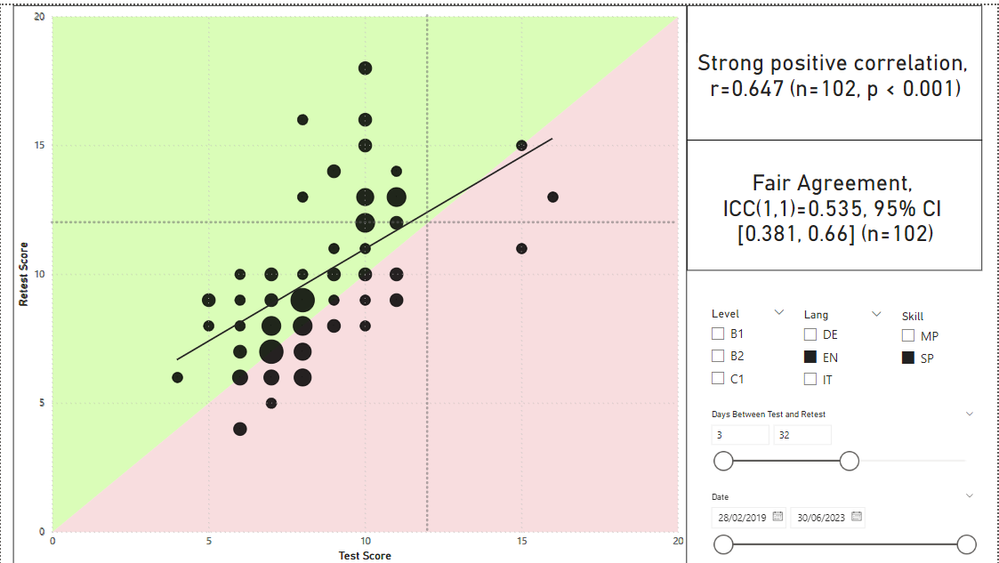

This is pretty awesome! I thought it was weird that PowerBI has functions for the Beta distribution, but not the F distribution. I spent a few hours reflecting on how to use the T distribution or Beta distribution functions to calcuate F.INV. I needed it desparately to dynamically calculate confidence intervals to report a measure of interclass correlation. I was just about to give up and write a complaint to Microsoft when I stumbled upon this great post! Thanks a lot, @Greg_Deckler! This is not the first time you have helped me through such problems!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pasting in an example of the F.INV measure being used in a report to calculate the confidence intervals for an interclass correlation coefficient. Pretty cool to get a dynamic calcuation that works with filters!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

And here is the code to calculate ICC with interpretation and confidence intervals.

Test_Retest_ICC =

VAR n = COUNTROWS('TEST_RETEST')

VAR nT = n*2

VAR k = 2

VAR AvgT = DIVIDE(SUM('TEST_RETEST'[Test Score]) + SUM('TEST_RETEST'[Retest Score]),nT)

VAR SST = SUMX('TEST_RETEST', ('TEST_RETEST'[Test Score]-AvgT)*('TEST_RETEST'[Test Score]-AvgT)) + SUMX('TEST_RETEST', ('TEST_RETEST'[Retest Score]-AvgT)*('TEST_RETEST'[Retest Score]-AvgT))

VAR SSW = SUMX('TEST_RETEST',

('TEST_RETEST'[Test Score]-DIVIDE('TEST_RETEST'[Retest Score]+'TEST_RETEST'[Test Score],k)) *

('TEST_RETEST'[Test Score]-DIVIDE('TEST_RETEST'[Retest Score]+'TEST_RETEST'[Test Score],k)) +

('TEST_RETEST'[Retest Score]-DIVIDE('TEST_RETEST'[Retest Score]+'TEST_RETEST'[Test Score],k)) *

('TEST_RETEST'[Retest Score]-DIVIDE('TEST_RETEST'[Retest Score]+'TEST_RETEST'[Test Score],k)))

VAR SSB = SST-SSW

VAR DFW = (n*k)-n

VAR DFB = n-1

VAR MSB=DIVIDE(SSB,DFB)

VAR MSW=DIVIDE(SSW,DFW)

VAR ICC = (MSB-MSW)/(MSB+((k-1)*MSW))

Var CCT =

SWITCH(TRUE,

ICC>=-1 && ICC<0 ,"Invalid Estimate",

ICC=0 ,"No Agreement",

ICC>0 && ICC<0.4 ,"Poor Agreement",

ICC>=0.4 && ICC<0.6 ,"Fair Agreement",

ICC>=0.6 && ICC<0.75 ,"Good Agreement",

ICC>=0.75 && ICC<1 ,"Excellent Agreement",

ICC=1 ,"Perfect Agreement"

)

VAR F = MSB/MSW

VAR alpha = 0.05

VAR alpha_Tail = alpha/2

/* The next two variables are taken from the F.INV measure provided by Greg. Ideal to report confidence intervals with the ICC, and you need F.INV to calculate those. This is but just one example of a practical application of Greg's measure. It can also be used for ANOVA stats, for example. Until the PBI developers add F.DIST and F.INV DAX functions, I will be borrowing this measure! */

VAR FINV_L = BETA.INV(1-alpha_Tail,DFB/2,DFW/2) * DFW/(DFB*(1-BETA.INV(1-alpha_Tail,DFB/2,DFW/2)))

VAR FINV_U = BETA.INV(1-alpha_Tail,DFW/2,DFB/2) * DFB/(DFW*(1-BETA.INV(1-alpha_Tail,DFW/2,DFB/2)))

VAR F_L = DIVIDE(F,FINV_L)

VAR F_U = F*FINV_U

VAR LOWER_ = DIVIDE(F_L-1,F_L+k-1)

VAR UPPER_ = DIVIDE(F_U-1,F_U+k-1)

RETURN CCT & ", ICC(1,1)=" & ROUND(ICC,3) & ", 95% CI [" & ROUND(LOWER_,3) & ", " & ROUND(UPPER_,3) &"]" & " (n=" & n & ")"- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you very much! I was looking for the equivalent of Statistics.FDistribution in DAX, and this works great, very handy indeed!