Join us at the 2025 Microsoft Fabric Community Conference

Microsoft Fabric Community Conference 2025, March 31 - April 2, Las Vegas, Nevada. Use code FABINSIDER for a $400 discount.

Register now- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Webinars and Video Gallery

- Data Stories Gallery

- Themes Gallery

- Power BI DataViz World Championships Gallery

- Quick Measures Gallery

- R Script Showcase

- COVID-19 Data Stories Gallery

- Community Connections & How-To Videos

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI DataViz World Championships are on! With four chances to enter, you could win a spot in the LIVE Grand Finale in Las Vegas. Show off your skills.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- prior negative balances

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prior negative balances

Hi everyone,

From a series of yearly results (loss or profit), I'm trying to calculate taxable income. In a loss year, taxable income is 0, and that loss can be compensated with further profits. In a profit year, prior losses can be compensated up to current year's pofit value so that taxable income must be >=0. If prior losses exceed current profit, that excess can be compensated in further years. However, if in a particular year there are no previos losses to be compensated, current profit cannot be used to compensate further losses.

The outcome I'm after should be something like this:

| Year | Result before taxes | Previous losses compensation | Previuous losses balance | Taxable income |

| 2023 | (84.157,09) | (84.157,09) | ||

| 2024 | 217.402,26 | (84.157,09) | - | 133.245,17 |

| 2025 | 62.194,10 | - | - | 62.194,10 |

| 2026 | (296.847,05) | (296.847,05) | ||

| 2027 | 1.291.593,25 | (296.847,05) | - | 994.746,19 |

| 2028 | 1.489.197,68 | - | 1.489.197,68 | |

| 2029 | (7.000.000,00) | (7.000.000,00) | ||

| 2030 | 2.245.409,81 | (2.245.409,81) | (4.754.590,19) | - |

| 2031 | 2.737.866,17 | (2.737.866,17) | (2.016.724,02) | - |

| 2032 | (5.000.000,00) | (7.016.724,02) | (5.000.000,00) | |

| 2033 | (1.000.000,00) | (8.016.724,02) | (1.000.000,00) | |

| 2034 | 4.248.651,56 | (4.248.651,56) | (3.768.072,46) | - |

| 2035 | 4.567.252,50 | (3.768.072,46) | - | 799.180,04 |

| 2036 | 4.895.556,20 | - | 4.895.556,20 |

The issue here is that "Previuous losses compensation" depend on "Previous losses balance", and viceversa. I've tried with both measures and/or calculated columns, to no avail.

Any suggest here will be much appreciated. Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why does 2034 and 2035 have taxable negative income but 2023 (for example ) does not?

In any case - Power BI has no memory and has no concept of variables. You cannot solve this in DAX. It might be possible to do it in Power Query as List.Accumulate is a bit more powerful than SUMX. But in general you should not be using Power BI for these complex state based computations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For what it's worth, I think I came out with some sort of solution here. Data lie in [Tabla5], and I defined:

Year's result = SUM(Tabla5[RCAT])In the first place, I considered that every time there's a positive result immediately after a loss, there must be a compensation:

Last year's loss compensation =

VAR _Comp=

SUMX(Tabla5,

VAR _CurrentResult= [Year's result]

VAR _LastResult=MAXX(FILTER(ALL(Tabla5),Tabla5[Year]=EARLIER(Tabla5[Year])-1),[Year's result])

RETURN

IF(

AND(_LastResult<0, _CurrentResult>0),

MIN(_CurrentResult,ABS(_LastResult)),0

)

)

RETURN

_CompSecondly, we need to find out the amount of tax credit available after this first compensation, by means of:

Cumm First compensation =

CALCULATE([Last year's loss compensation], FILTER(ALL(Tabla5),Tabla5[Year]<=MAX(Tabla5[Year])))and

Prior losses =

SUMX(FILTER(ALL(Tabla5),Tabla5[Year]and

Tax credit available = [Prior losses]-[Cumm First compensation]The third step would be comparing this tax credit still available to the amount of profit available for compensation:

Profit available for compensation =

IF(

AND([Year's result]>0, [Tax credit available]>0),

[Year's result]-[Last year's loss compensation],0

)and

Cumm Second Compensation =

MIN(SUMX(FILTER(ALL(Tabla5),Tabla5[Year]<=MAX(Tabla5[Year])),IF(AND([Year's result]>0, [Tax credit available]>0),[Profit available for compensation])),[Tax credit available])The difference between years of this last measure will bring the value of the current year´s second compensation:

Prior years losses compensation =

[Cumm Second Compensation]- MAXX(FILTER(ALL(Tabla5), Tabla5[Year]=MAX(Tabla5[Year])-1),[Cumm Second Compensation])Finally, we just need to sum both compensations and substract that value from current year's profit in order to find taxable income:

Total compensation = [Last year's loss compensation]+[Prior years losses compensation]and

Taxable income =

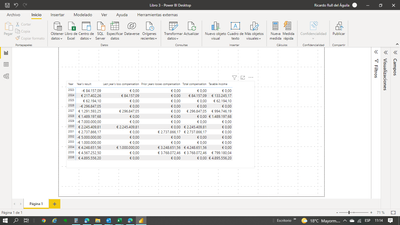

IF([Year's result]>0, [Year's result]-[Total compensation],0)The outcome would be something like

I've been trying to buid a one-measure-only solution, but I came across with some row/filter context issues that made it too complicated to me. Maybe someone could sort this out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you for your interest.

Year 2023 is the first in the series: even if it was a profit year, there's no previous result to compensate with.

Years 2034 or 2035 are profit years. In any given profit year, prior negative results can be compensated with positive current result. For instance, in 2024 the whole loss from 2023 is applied; the same goes with 2027 against 2026. Year 2030 makes some different case: current profit is not enough to cover the whole loss from 2029: therefore the excess can be applied to futher years profit.

I hope my answer is clear enough. Should you neeed further clarification, please do not hesitate to ask again.

Helpful resources

Join us at the Microsoft Fabric Community Conference

March 31 - April 2, 2025, in Las Vegas, Nevada. Use code MSCUST for a $150 discount!

Power BI Monthly Update - February 2025

Check out the February 2025 Power BI update to learn about new features.

| User | Count |

|---|---|

| 85 | |

| 79 | |

| 54 | |

| 39 | |

| 35 |

| User | Count |

|---|---|

| 102 | |

| 82 | |

| 48 | |

| 48 | |

| 48 |