New Offer! Become a Certified Fabric Data Engineer

Check your eligibility for this 50% exam voucher offer and join us for free live learning sessions to get prepared for Exam DP-700.

Get Started- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

Don't miss out! 2025 Microsoft Fabric Community Conference, March 31 - April 2, Las Vegas, Nevada. Use code MSCUST for a $150 discount. Prices go up February 11th. Register now.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- St. Deviation of Portfolio Returns

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

St. Deviation of Portfolio Returns

Hi everyone,

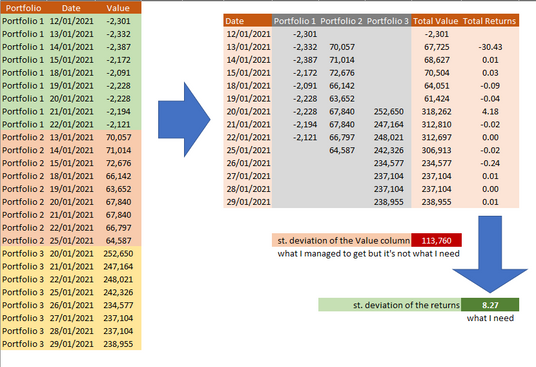

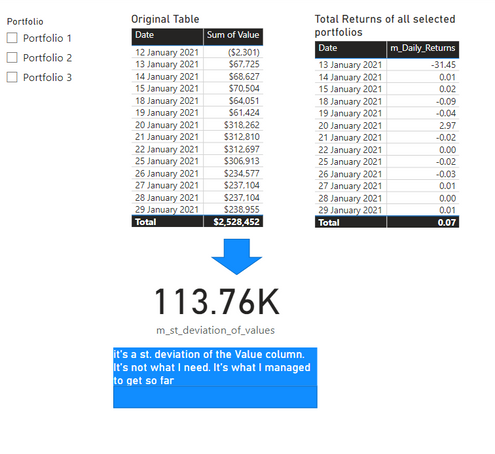

I have a table with some portfolios and their daily values. Negative values mean they are short some assets.

My ultimate goal is to get a standard deviation of the combined daily returns of selected portfolios. So if I select Portfolio 1 and Portfolio 2, I want a st. deviation of the combined returns of the two.

I only managed to get a st. deviation of the Value column. But it's not what I need. I'm struggling to find a solution to my problem.

The returns = (ValueToday - ValueYesterday) / ValueYesterday

The pbix file is saved here

Will appreciate your help.

Thanks very much.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you for providing the sample data. That helps a lot with proposing a potential solution.

Small comment: your "Day over Day" measure includes transition from negative to positive values. In that scenario it is advisable to adjust the formula to use the absolute of the prior value.

m_Daily_Returns =

VAR thisvalue =

MAX ( 'Table'[value] )

VAR thisdate =

MAX ( 'Table'[Date] )

VAR prevvalue =

CALCULATE (

LASTNONBLANKVALUE (

'Table'[Date],

MAX ( 'table'[value] )

),

FILTER (

ALL ( 'Table'[Date] ),

'table'[Date] < thisdate

)

)

RETURN

DIVIDE (

(thisvalue - prevvalue),

abs(prevvalue)

)

Next you need to rethink your entire approach. For example

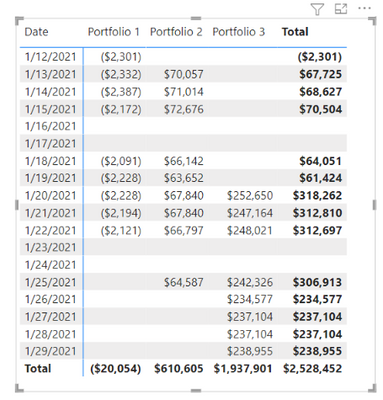

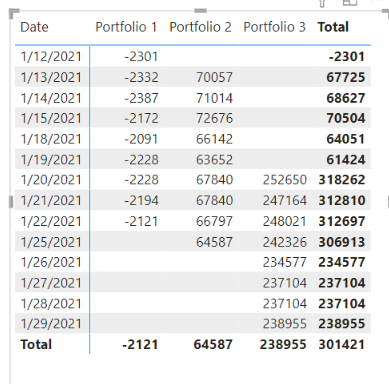

You have gaps in your dates (weekends, I assume) that you will need to take into account (or not - but you need to decide). You can also see that the row totals are incorrect. They need to be calculated separately for each portfolio based not on the sum, not on the maximum, but on the last value.

Pval =

var a = values(Portfolios[Portfolio])

var b = ADDCOLUMNS(a,"md",var p=[Portfolio] return CALCULATE(max('Table'[Date]),'Table'[Portfolio]=p))

var c = ADDCOLUMNS(b,"mv",var md=[md] var p =[Portfolio] return CALCULATE(sum('Table'[Value]),'Table'[Date]=md,'Table'[Portfolio]=p))

return sumx(c,[mv])

The same is then true for the daily returns and the standard deviation. See attached.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In your measure get a list of all dates in the current filter context, then compute the return for each, and finally run the standard deviation function over that table.

Please provide sanitized sample data that fully covers your issue.

https://community.powerbi.com/t5/Community-Blog/How-to-provide-sample-data-in-the-Power-BI-Forum/ba-...

Please show the expected outcome based on the sample data you provided.

https://community.powerbi.com/t5/Desktop/How-to-Get-Your-Question-Answered-Quickly/m-p/1447523

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi lbendlin,

Thanks for your reply. The pbix file is saved here.

It'll be so great if you can help me with this.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you for providing the sample data. That helps a lot with proposing a potential solution.

Small comment: your "Day over Day" measure includes transition from negative to positive values. In that scenario it is advisable to adjust the formula to use the absolute of the prior value.

m_Daily_Returns =

VAR thisvalue =

MAX ( 'Table'[value] )

VAR thisdate =

MAX ( 'Table'[Date] )

VAR prevvalue =

CALCULATE (

LASTNONBLANKVALUE (

'Table'[Date],

MAX ( 'table'[value] )

),

FILTER (

ALL ( 'Table'[Date] ),

'table'[Date] < thisdate

)

)

RETURN

DIVIDE (

(thisvalue - prevvalue),

abs(prevvalue)

)

Next you need to rethink your entire approach. For example

You have gaps in your dates (weekends, I assume) that you will need to take into account (or not - but you need to decide). You can also see that the row totals are incorrect. They need to be calculated separately for each portfolio based not on the sum, not on the maximum, but on the last value.

Pval =

var a = values(Portfolios[Portfolio])

var b = ADDCOLUMNS(a,"md",var p=[Portfolio] return CALCULATE(max('Table'[Date]),'Table'[Portfolio]=p))

var c = ADDCOLUMNS(b,"mv",var md=[md] var p =[Portfolio] return CALCULATE(sum('Table'[Value]),'Table'[Date]=md,'Table'[Portfolio]=p))

return sumx(c,[mv])

The same is then true for the daily returns and the standard deviation. See attached.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks very much for your help!

This solved my problem.

Helpful resources

Join us at the Microsoft Fabric Community Conference

March 31 - April 2, 2025, in Las Vegas, Nevada. Use code MSCUST for a $150 discount! Prices go up Feb. 11th.

Power BI Monthly Update - January 2025

Check out the January 2025 Power BI update to learn about new features in Reporting, Modeling, and Data Connectivity.

| User | Count |

|---|---|

| 143 | |

| 75 | |

| 62 | |

| 51 | |

| 47 |

| User | Count |

|---|---|

| 213 | |

| 81 | |

| 64 | |

| 60 | |

| 56 |