FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

Vote for your favorite vizzies from the Power BI Dataviz World Championship submissions. Vote now!

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Aggregate alternate rows

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Aggregate alternate rows

OK, so this one has me totally stumped.

I have a list of swap transactions, where financial instruments are exchanged on day one, and are swapped back on day x at the end of the term.

For each transaction I have a reference, a trade date, a buy or sell and a rate. For each transaction I then have the opposite data on the next line. This means I have a table with all the correct data.

Now I need to put the data in line 2 alongside the data in line 1 so that I have a single line per transaction. I can then add the details I need to add into a new column and off we go. Except I have no clue how to place the details in line 2 into columns next to the original line 1 trade.

Any clues???

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @wooand,

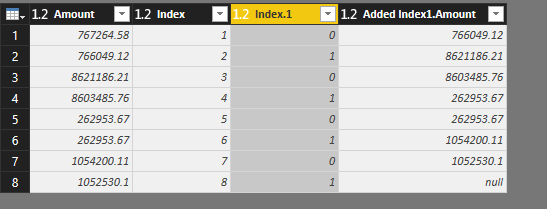

To get the second line of data you could try this pattern.

1. Add a new index column starting at 1

2. Add another new index column starting at 0

3. Merge Query - using the same table (left outer join) merge on the index columns (first index column from the table shown on the top with the second index column from the table on the bottom.

4. Transform one of the index columns with modulo 2 (from the standard math transformations)

5. Filter out that column on 1

6. Expand the table

MarkS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @wooand,

To get the second line of data you could try this pattern.

1. Add a new index column starting at 1

2. Add another new index column starting at 0

3. Merge Query - using the same table (left outer join) merge on the index columns (first index column from the table shown on the top with the second index column from the table on the bottom.

4. Transform one of the index columns with modulo 2 (from the standard math transformations)

5. Filter out that column on 1

6. Expand the table

MarkS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mark,

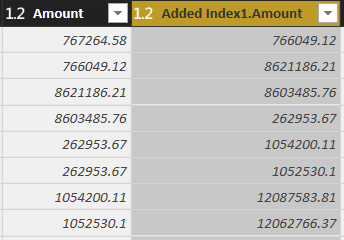

I have a question. I have been using your answer to this question for some time with great success, but I am struggling when I have two rows the same. See below - lines 5 and 6 are the same amount - but when I use this process to bring the lines alongside one another the duiplicated information seems to create a problem in that it only mirrors the row once, thereby making every line one line out. I've tried using 'Full Outer' but that didn't work.

Any ideas?

A.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Well done Mark, that's nailed it.

Many thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @wooand

If each transaction has a unique reference and 2 rows only, I believe it should be doable

Could you paste some sample data and expected reults?

May be 10-15 rows of sample data and your desired RESULT

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks Zubair. I've taken the amounts out, but I'm sure you get the gist:

| Pair | Trade Date | Value Date | Trade Type | CUST Side Allocation | Amount | BUY CCY | SELL CCY | USD Cost | USD Amount |

| EURCHF | 03/01/2017 | 06/01/2017 | SWAP | SELL | 10.00 | CHF | EUR | 1.00 | 10.00 |

| EURCHF | 03/01/2017 | 11/01/2017 | SWAP | BUY | 10.00 | EUR | CHF | 1.00 | 10.00 |

| EURCHF | 03/01/2017 | 06/01/2017 | SWAP | BUY | 10.00 | EUR | CHF | 1.00 | 10.00 |

| EURCHF | 03/01/2017 | 11/01/2017 | SWAP | SELL | 10.00 | CHF | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 01/02/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 04/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 04/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 01/02/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 31/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 05/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 31/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 05/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 11/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 06/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

And the target is to have the far legs currently on the second row captured alongside their near legs:

| Pair | Trade Date | Value Date | Trade Type | CUST Side Allocation | Amount | BUY CCY | SELL CCY | USD Cost | USD Amount | Value Date | Trade Type | CUST Side Allocation | Amount | BUY CCY | SELL CCY | USD Cost | USD Amount |

| EURCHF | 03/01/2017 | 06/01/2017 | SWAP | SELL | 10.00 | CHF | EUR | 1.00 | 10.00 | 11/01/2017 | SWAP | BUY | 10.00 | EUR | CHF | 1.00 | 10.00 |

| EURCHF | 03/01/2017 | 06/01/2017 | SWAP | BUY | 10.00 | EUR | CHF | 1.00 | 10.00 | 11/01/2017 | SWAP | SELL | 10.00 | CHF | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 01/02/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 | 04/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 04/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 | 01/02/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 31/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 | 05/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 31/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 | 05/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

| EURGBP | 03/01/2017 | 11/01/2017 | SWAP | BUY | 10.00 | EUR | GBP | 1.00 | 10.00 | 06/01/2017 | SWAP | SELL | 10.00 | GBP | EUR | 1.00 | 10.00 |

Helpful resources

Power BI Dataviz World Championships

Vote for your favorite vizzies from the Power BI World Championship submissions!

Join our Community Sticker Challenge 2026

If you love stickers, then you will definitely want to check out our Community Sticker Challenge!

Power BI Monthly Update - January 2026

Check out the January 2026 Power BI update to learn about new features.

| User | Count |

|---|---|

| 55 | |

| 52 | |

| 41 | |

| 16 | |

| 16 |

| User | Count |

|---|---|

| 107 | |

| 103 | |

| 40 | |

| 33 | |

| 25 |