FabCon is coming to Atlanta

Join us at FabCon Atlanta from March 16 - 20, 2026, for the ultimate Fabric, Power BI, AI and SQL community-led event. Save $200 with code FABCOMM.

Register now!- Power BI forums

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Data Stories Gallery

- Themes Gallery

- Contests Gallery

- QuickViz Gallery

- Quick Measures Gallery

- Visual Calculations Gallery

- Notebook Gallery

- Translytical Task Flow Gallery

- TMDL Gallery

- R Script Showcase

- Webinars and Video Gallery

- Ideas

- Custom Visuals Ideas (read-only)

- Issues

- Issues

- Events

- Upcoming Events

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now! Learn more

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Dynamically referencing above rows in the same col...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dynamically referencing above rows in the same column

Hi Community,

How can we reference the row above using dax

| Material QTY | Rate | Date | X Closing Stock | Correct Closing stock | Index |

| 0 | 0.2 | 11-Apr-23 | 0 | 0 | 0 |

| 0 | 0.2 | 12-Apr-23 | 0 | 0 | 1 |

| 0 | 0.2 | 13-Apr-23 | 0 | 0 | 2 |

| 0 | 0.2 | 14-Apr-23 | 0 | 0 | 3 |

| 0 | 0.2 | 15-Apr-23 | 0 | 0 | 4 |

| 0 | 0.2 | 16-Apr-23 | 0 | 0 | 5 |

| 150000 | 0.2 | 17-Apr-23 | 150000 | 150000 | 6 |

| 1000 | 0.2 | 18-Apr-23 | 121000 | 121000 | 7 |

| 0 | 0.2 | 19-Apr-23 | 96800 | 96800 | 8 |

| 100000 | 0.15 | 20-Apr-23 | 177440 | 177440 | 9 |

| 0 | 0.15 | 21-Apr-23 | 146952 | 150824 | 10 |

| 0 | 0.15 | 22-Apr-23 | 121811.6 | 128200.4 | 11 |

| 0 | 0.15 | 23-Apr-23 | 101061.78 | 108970.34 | 12 |

| 0 | 0.15 | 24-Apr-23 | 83920.049 | 92624.789 | 13 |

need to calculate the data in correct closing stock (excel formula used is: =E2*(1-B3)+A3 in the E3)

with the help @tamerj1 and making minor changes to the solution given by @tamerj1 to a similar problem I could come up with

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

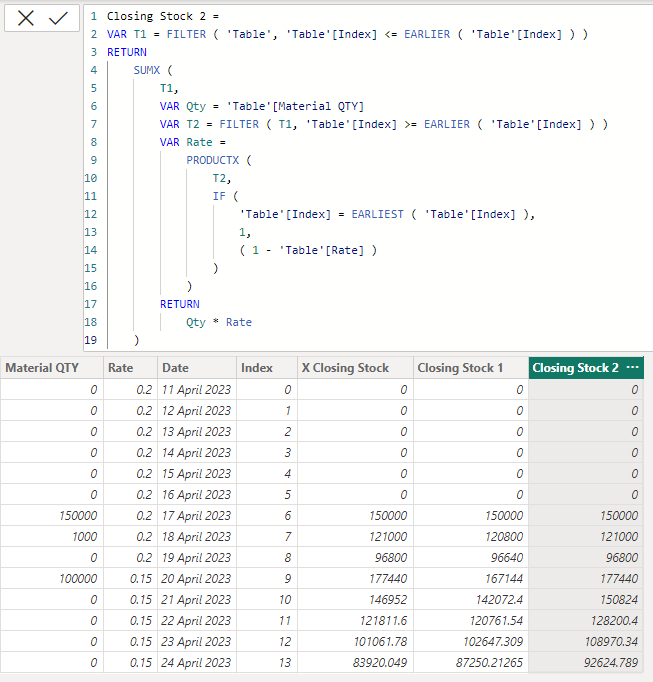

@NaveenMD

Here you go

Closing Stock 2 =

VAR T1 = FILTER ( 'Table', 'Table'[Index] <= EARLIER ( 'Table'[Index] ) )

RETURN

SUMX (

T1,

VAR Qty = 'Table'[Material QTY]

VAR T2 = FILTER ( T1, 'Table'[Index] >= EARLIER ( 'Table'[Index] ) )

VAR Rate =

PRODUCTX (

T2,

IF (

'Table'[Index] = EARLIEST ( 'Table'[Index] ),

1,

( 1 - 'Table'[Rate] )

)

)

RETURN

Qty * Rate

)- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

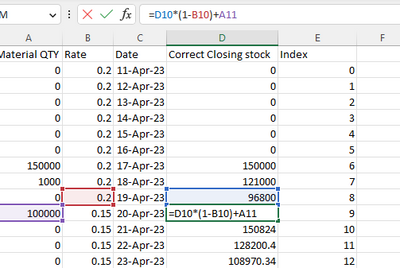

Sorry for the concern @tamerj1 !

Excel Formula : =D2*(1-B2)+A3

| Material QTY | Rate | Date | Correct Closing stock |

| 0 | 0.2 | 11-Apr-23 | 0 |

| 0 | 0.2 | 12-Apr-23 | 0 |

| 0 | 0.2 | 13-Apr-23 | 0 |

| 0 | 0.2 | 14-Apr-23 | 0 |

| 0 | 0.2 | 15-Apr-23 | 0 |

| 0 | 0.2 | 16-Apr-23 | 0 |

| 150000 | 0.2 | 17-Apr-23 | 150000 |

| 1000 | 0.2 | 18-Apr-23 | 121000 |

| 0 | 0.2 | 19-Apr-23 | 96800 |

| 100000 | 0.15 | 20-Apr-23 | 177440 |

| 0 | 0.15 | 21-Apr-23 | 150824 |

| 0 | 0.15 | 22-Apr-23 | 128200.4 |

| 0 | 0.15 | 23-Apr-23 | 108970.34 |

| 0 | 0.15 | 24-Apr-23 | 92624.789 |

You can use the link for accessing the file : https://docs.google.com/spreadsheets/d/1E8obh8vJHHI6OX8FSEzTQ4_iM4OSGdQY/edit?usp=sharing&ouid=10327...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@NaveenMD

Here you go

Closing Stock 2 =

VAR T1 = FILTER ( 'Table', 'Table'[Index] <= EARLIER ( 'Table'[Index] ) )

RETURN

SUMX (

T1,

VAR Qty = 'Table'[Material QTY]

VAR T2 = FILTER ( T1, 'Table'[Index] >= EARLIER ( 'Table'[Index] ) )

VAR Rate =

PRODUCTX (

T2,

IF (

'Table'[Index] = EARLIEST ( 'Table'[Index] ),

1,

( 1 - 'Table'[Rate] )

)

)

RETURN

Qty * Rate

)- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @tamerj1 - thank you for this very good solution. I managed to solve a very similar problem using the solution from Closing Stock 1, which fits the best for my need. I'm struggling now to make it interactive by filters, meaning that I would like to make it a measure instead of a calculated column.

In my case it's like a have a measure for Material QTY and Rate, then I would like to create te Closing Stock 1 as a measure. Do you think this would be possible?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @JoaoSimas

Please provide a sample file along with clear illustration of the requirement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @tamerj1 - find the illustration of the requirement and the sample file below

#Cumulative Supply (Column) =

VAR MinIndex = MINX(FILTER(ProjectionYears,ProjectionYears[#Supply Balance (Column)]>0),ProjectionYears[Year Index])

VAR T1 = FILTER(ProjectionYears, ProjectionYears[Year Index] <= EARLIER (ProjectionYears[Year Index]))

RETURN

SUMX(T1,

VAR Qty = ProjectionYears[#Supply Balance (Column)]

VAR T2 = FILTER (T1,ProjectionYears[Year Index] >= EARLIER (ProjectionYears[Year Index]))

VAR Rate = PRODUCTX (T2,IF(ProjectionYears[Year Index] = MinIndex,1,(1 - [Attrition])))

RETURN

Qty * Rate)#Cumulative Supply (Measure) =

VAR CurrentYearIndex = MAX(ProjectionYears[Year])

VAR DecayFactor = 1 - [Attrition]

RETURN

SUMX(FILTER(

ALLSELECTED(ProjectionYears),

ProjectionYears[Year] <= CurrentYearIndex),

VAR Supply = [#Supply Balance (Measure)]

VAR YearDifference = CurrentYearIndex - ProjectionYears[Year]

RETURN

Supply * POWER(DecayFactor, YearDifference))

Link to .pbix sample file:

https://drive.google.com/file/d/1lqGJ9PFQSAIw6wiZPSd1dAYwuVVSMVNt/view?usp=sharing

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @tamerj1

I was able to solve the problem by adding a condition for the YearDifference.

Thanks anyway!

#Cumulative Supply (Measure) =

VAR CurrentYearIndex = MAX(ProjectionYears[Year Index]) -- Get the current year index

VAR DecayFactor = 1 - [Attrition] -- Define the decay factor as 1 minus the attrition rate

RETURN

SUMX(FILTER(

ALLSELECTED(ProjectionYears),

ProjectionYears[Year Index] <= CurrentYearIndex), -- Only consider years up to the current year

VAR Supply = [#Supply Balance (Measure)] -- Get the supply for the current year

VAR YearDifference = CurrentYearIndex - ProjectionYears[Year Index] -- How far back in time this year is

VAR FixedDifference = IF(ProjectionYears[Year Index]>=1,YearDifference+1,YearDifference) --CORRECTION

RETURN

Supply*POWER(DecayFactor,FixedDifference)

)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@NaveenMD See my article on Mean Time Between Failure (MTBF) which uses EARLIER: http://community.powerbi.com/t5/Community-Blog/Mean-Time-Between-Failure-MTBF-and-Power-BI/ba-p/3395....

The basic pattern is:

Column =

VAR __Current = [Value]

VAR __PreviousDate = MAXX(FILTER('Table','Table'[Date] < EARLIER('Table'[Date])),[Date])

VAR __Previous = MAXX(FILTER('Table',[Date]=__PreviousDate),[Value])

RETURN

__Current - __Previous

Follow on LinkedIn

@ me in replies or I'll lose your thread!!!

Instead of a Kudo, please vote for this idea

Become an expert!: Enterprise DNA

External Tools: MSHGQM

YouTube Channel!: Microsoft Hates Greg

Latest book!: DAX For Humans

DAX is easy, CALCULATE makes DAX hard...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Greg_Deckler

This is a nice example of pseudo-recursive calculation that might be helpful to you for your new book.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

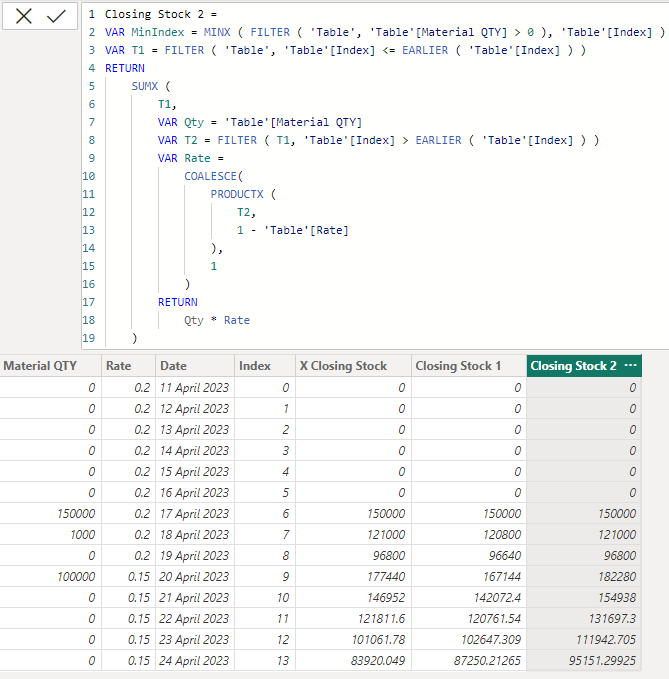

@NaveenMD

There is no fixed pattern for what I call "Semi-Recursive" calculations.

Referring to the previous row in the same column that is under evalution is not possible in Power Bi as the whole column is evaluated as set not cell by cell as the case in excel. However, we can trace back the the calculation of the previous cell to notice that it is actually evaluated the existing values of other (existing) columns and the cell previous to it and so on until we reach to the very first cell which is being totally evaluated from other existing column(s).

This would require taking some advantage of mathmics. Assuming quantity column "Q" and (1 - [Ratio]) is R then we can write

Row1:

= Q1

Row2:

= Q1*R2 + Q2

Row3:

= (Row2)*R3 + Q3

= (Q1*R2 + Q2)*R3 + Q3

= Q1*R2*R3 + Q2*R3 + Q4

Similarly Row4 would be:

= Q1*R2*R3*R4 + Q2*R3*R4 + Q3*R4 + Q4

And so on...If we look closely to Row4

Now it is a matter to find the tables that need to be iterated inside each of these two iterators. The rest is just fine tuning some details.

Closing Stock 2 =

VAR MinIndex = MINX ( FILTER ( 'Table', 'Table'[Material QTY] > 0 ), 'Table'[Index] )

VAR T1 = FILTER ( 'Table', 'Table'[Index] <= EARLIER ( 'Table'[Index] ) )

RETURN

SUMX (

T1,

VAR Qty = 'Table'[Material QTY]

VAR T2 = FILTER ( T1, 'Table'[Index] > EARLIER ( 'Table'[Index] ) )

VAR Rate =

COALESCE(

PRODUCTX (

T2,

1 - 'Table'[Rate]

),

1

)

RETURN

Qty * Rate

)- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@tamerj1 this is where I am facing an issue by using the DAX

column 3 is the required rate% and column 2 is the actual rate % that has been calculated using the DAX.

I am hypothesising that somewhere the rate values are getting averaged out thus we are facing this problem.

| Material QTY | Rate | Date | Correct Closing stock | Index |

| 0 | 0.2 | 11-Apr-23 | 0 | 0 |

| 0 | 0.2 | 12-Apr-23 | 0 | 1 |

| 0 | 0.2 | 13-Apr-23 | 0 | 2 |

| 0 | 0.2 | 14-Apr-23 | 0 | 3 |

| 0 | 0.2 | 15-Apr-23 | 0 | 4 |

| 0 | 0.2 | 16-Apr-23 | 0 | 5 |

| 150000 | 0.2 | 17-Apr-23 | 150000 | 6 |

| 1000 | 0.2 | 18-Apr-23 | 121000 | 7 |

| 0 | 0.25 | 19-Apr-23 | 90750 | 8 |

| 100000 | 0.15 | 20-Apr-23 | 168062.5 | 9 |

| 0 | 0.12 | 21-Apr-23 | 147895 | 10 |

| 0 | 0.3 | 22-Apr-23 | 103526.5 | 11 |

| 0 | 0.15 | 23-Apr-23 | 87997.525 | 12 |

| 0 | 0.15 | 24-Apr-23 | 74797.89625 | 13 |

this a new data with much more variablity in the rate.

It would be great relief if you can help me with this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sorry I did not understand your problem. Please explain further and don't assume I have any idea about your data, calculations or requirements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you see the date 19 April 23 the Material Quantity (96800) should be multiplied by 0.8 ie. (1-0.2) and the result should be 77440 but when we use the above mentioned DAX the Material quantity gets multiplied by 0.85 ie. (1-1.5) and the result optained is 82280.

Somehow the the material quantity of 19th April gets multiplied by rate of 20th April.

DAX:

Closing Stock 2 =

VAR MinIndex = MINX ( FILTER ( 'Table', 'Table'[Material QTY] > 0 ), 'Table'[Index] )

VAR T1 = FILTER ( 'Table', 'Table'[Index] <= EARLIER ( 'Table'[Index] ) )

RETURN

SUMX (

T1,

VAR Qty = 'Table'[Material QTY]

VAR T2 = FILTER ( T1, 'Table'[Index] > EARLIER ( 'Table'[Index] ) )

VAR Rate =

COALESCE(

PRODUCTX (

T2,

1 - 'Table'[Rate]

),

1

)

RETURN

Qty * Rate

)Do let me know if any other clarificaion is required

Thanks @tamerj1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"E2*(1-B3)+A3 in the E3" this is your excel formula. I plugged it in an excel sheet and got exactly the same results of the DAX formula. Please specify the correct excel formula to work with.

Helpful resources

Power BI Dataviz World Championships

The Power BI Data Visualization World Championships is back! Get ahead of the game and start preparing now!

| User | Count |

|---|---|

| 19 | |

| 13 | |

| 10 | |

| 4 | |

| 4 |

| User | Count |

|---|---|

| 31 | |

| 28 | |

| 19 | |

| 11 | |

| 10 |