- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: IF/OR Statement with Measure & Column

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IF/OR Statement with Measure & Column

I created a measure which sums the column "profit/loss" by column "master portolio id"...

Net FX P&L2 = CALCULATE (

SUM ( 'daily_report'[profit/loss]),

FILTER (

ALLSELECTED ( 'daily_report' ),

'daily_report'[master portfolio id]

= SELECTEDVALUE ( 'daily_report'[master portfolio id] )

))

For example,

My data sheet contains the following columns

Facility Code Master Portfolio ID Profit/Loss Net FX P&L2 <-- Measure created using formula above

84151 84151 0 100

84152 84151 50 100

84153 84151 50 100

The measure above rolls up the profit/loss (3rd column) value by the master porfolio id (2nd column).

However, I also need the facility codes (1st column) 84152 and 84153 be 0 as they should not contain 100. The 100 profit and loss value should only be in the Facility code 84151 as that is the main facility.

I tried to use an IF/OR statement but cannot when Facility Code is a column and Net FX P&L2 is a measure. Also, I have about 5 other facility codes with this issue. Can someone please help?

Facility Code Master Portfolio ID Profit/Loss Net FX P&L2 <-- What the Net FX P&L2 column should look like

84151 84151 0 100

84152 84151 50 0

84153 84151 50 0

Thank you!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

Thank you for your message.

Could you please try something like below?

Net FX P&L2 Sample Data 2 measure: =

VAR _masterid =

MAX ( SampleData2[Master Portfolio ID] )

VAR _currentdate =

MAX ( SampleData2[Run Date] )

RETURN

SUMX (

ADDCOLUMNS (

FILTER (

SampleData2,

SampleData2[Facility Code] = SampleData2[Master Portfolio ID]

),

"@expectedmeasure",

CALCULATE (

SUMX (

FILTER (

ALL ( SampleData2 ),

SampleData2[Master Portfolio ID] = _masterid

&& SampleData2[Run Date] = _currentdate

),

SampleData2[Profit/Loss]

)

)

),

[@expectedmeasure]

) + 0

If this post helps, then please consider accepting it as the solution to help other members find it faster, and give a big thumbs up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello @Jihwan_Kim,

Thank you for the response. After copy and pasting the code above, I received a larger number. I should have mentioned that the report is being filtered (slicer) by a column titled "Run Date" which contains date data (report runs on a daily basis). I am not sure if this is why I am seeing a large number because it is summing all the dates together? Just added this column to the chart below for reference.

Run Date Facility Code Master Portfolio ID Profit/Loss Net FX P&L2

7/11/2022 84151 84151 0 100

7/11/2022 84152 84151 50 100

7/11/2022 84153 84151 50 100

7/8/2022 84151 84151 0 160

7/8/2022 84152 84151 80 160

7/8/2022 84153 84151 80 160

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

Thank you for your message.

Could you please try something like below?

Net FX P&L2 Sample Data 2 measure: =

VAR _masterid =

MAX ( SampleData2[Master Portfolio ID] )

VAR _currentdate =

MAX ( SampleData2[Run Date] )

RETURN

SUMX (

ADDCOLUMNS (

FILTER (

SampleData2,

SampleData2[Facility Code] = SampleData2[Master Portfolio ID]

),

"@expectedmeasure",

CALCULATE (

SUMX (

FILTER (

ALL ( SampleData2 ),

SampleData2[Master Portfolio ID] = _masterid

&& SampleData2[Run Date] = _currentdate

),

SampleData2[Profit/Loss]

)

)

),

[@expectedmeasure]

) + 0

If this post helps, then please consider accepting it as the solution to help other members find it faster, and give a big thumbs up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

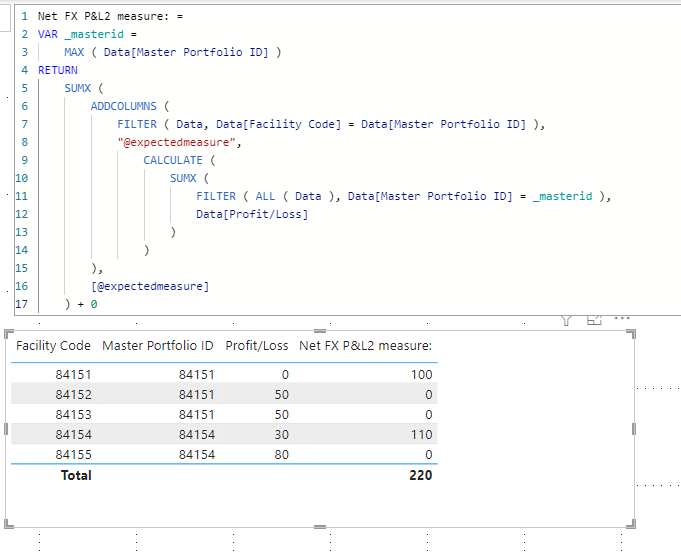

Hi,

Please check the below picture and the attached pbix file.

I tried to create a sample pibx file like below.

It is for creating a measure.

Net FX P&L2 measure: =

VAR _masterid =

MAX ( Data[Master Portfolio ID] )

RETURN

SUMX (

ADDCOLUMNS (

FILTER ( Data, Data[Facility Code] = Data[Master Portfolio ID] ),

"@expectedmeasure",

CALCULATE (

SUMX (

FILTER ( ALL ( Data ), Data[Master Portfolio ID] = _masterid ),

Data[Profit/Loss]

)

)

),

[@expectedmeasure]

) + 0If this post helps, then please consider accepting it as the solution to help other members find it faster, and give a big thumbs up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@gmasta1129 , Try like

Net FX P&L2 = CALCULATE (

SUM ( 'daily_report'[profit/loss]),

FILTER (

ALLSELECTED ( 'daily_report' ),

'daily_report'[master portfolio id]

= max ( 'daily_report'[master portfolio id] ) && 'daily_report'[Facility ID] = minx(filter('daily_report'[master portfolio id]

= max ( 'daily_report'[master portfolio id] ) ) 'daily_report'[Facility ID])

))

or

Net FX P&L2 = CALCULATE (

SUM ( 'daily_report'[profit/loss]),

FILTER (

( 'daily_report' ),

'daily_report'[Facility ID] = minx(filter('daily_report'[master portfolio id]

= max ( 'daily_report'[master portfolio id] ) ) 'daily_report'[Facility ID])

))

refer

https://amitchandak.medium.com/power-bi-get-the-last-latest-value-of-a-category-d0cf2fcf92d0

You need first means Min

Microsoft Power BI Learning Resources, 2023 !!

Learn Power BI - Full Course with Dec-2022, with Window, Index, Offset, 100+ Topics !!

Did I answer your question? Mark my post as a solution! Appreciate your Kudos !! Proud to be a Super User! !!

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 109 | |

| 99 | |

| 77 | |

| 66 | |

| 54 |

| User | Count |

|---|---|

| 144 | |

| 104 | |

| 102 | |

| 87 | |

| 64 |