- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- DATEDIFF to calculate number of months if Start da...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DATEDIFF to calculate number of months if Start date of month varies?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @DCrowther

Please see the below DAX expressions.

1 This address your requirement and will also address the issue with hard coded year.

Payment Month Count = VAR _NextSheduledDate = 'Table'[Next Scheduled Payment] VAR _NextSheduledYear = YEAR( _NextSheduledDate ) VAR _TaxCutoffDate = IF( DATE( _NextSheduledYear, 4, 5 ) > _NextSheduledDate, DATE( _NextSheduledYear, 4, 5 ), DATE( _NextSheduledYear + 1, 4, 5 ) ) VAR _DateDiff = DATEDIFF( _NextSheduledDate, _TaxCutoffDate, MONTH ) RETURN _DateDiff + IF( DAY( _NextSheduledDate ) <= 5, 1, 0 )

2 Version with hard coded Year

Payment Month Count = VAR _NextSheduledDate = 'Table'[Next Scheduled Payment] VAR _DateDiff = DATEDIFF( _NextSheduledDate, DATE( 2020, 4, 5 ), MONTH ) RETURN _DateDiff + IF( DAY( _NextSheduledDate ) <= 5, 1, 0 )

Mariusz

If this post helps, then please consider Accepting it as the solution.

Please feel free to connect with me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sorry, i didnt get to explain the content of my query

I am looking to calculat the number of months between a start date (payment date) and the the end date (end date being UK Tax year of 5/4/2020)

However there are set different start dates (Payment Date) so for example, so may be on on the 1st of the month, some maybe on 15th of the month and some on the 25th, however the DAX DATEDIFF function may result in a slight mis-calculation of payment months remaining depending on the start, can anyone help with this?

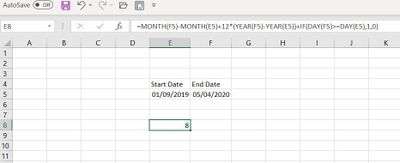

I have included below an excel formula that actually works so i am looking for the DAX equivalent

=MONTH(F5)-MONTH(E5)+12*(YEAR(F5)-YEAR(E5))+IF(DAY(F5)>=DAY(E5),1,0)

Regards

Dan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @DCrowther

Can you creater a small data sample + expected result?

Mariusz

If this post helps, then please consider Accepting it as the solution.

Please feel free to connect with me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi Mariusz

Above is the two examples, first image shows how PBI is resulting in a 7 month count no matter if the start date is on the 1st, 15th or 25th. The second image shows how excel can give a different month number calc of 8, depending if the day of the month changes. 8 months should be the correct output.

Hope this helps

Regards

Dan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @DCrowther

Please see the below DAX expressions.

1 This address your requirement and will also address the issue with hard coded year.

Payment Month Count = VAR _NextSheduledDate = 'Table'[Next Scheduled Payment] VAR _NextSheduledYear = YEAR( _NextSheduledDate ) VAR _TaxCutoffDate = IF( DATE( _NextSheduledYear, 4, 5 ) > _NextSheduledDate, DATE( _NextSheduledYear, 4, 5 ), DATE( _NextSheduledYear + 1, 4, 5 ) ) VAR _DateDiff = DATEDIFF( _NextSheduledDate, _TaxCutoffDate, MONTH ) RETURN _DateDiff + IF( DAY( _NextSheduledDate ) <= 5, 1, 0 )

2 Version with hard coded Year

Payment Month Count = VAR _NextSheduledDate = 'Table'[Next Scheduled Payment] VAR _DateDiff = DATEDIFF( _NextSheduledDate, DATE( 2020, 4, 5 ), MONTH ) RETURN _DateDiff + IF( DAY( _NextSheduledDate ) <= 5, 1, 0 )

Mariusz

If this post helps, then please consider Accepting it as the solution.

Please feel free to connect with me.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 114 | |

| 99 | |

| 83 | |

| 70 | |

| 60 |

| User | Count |

|---|---|

| 149 | |

| 114 | |

| 107 | |

| 89 | |

| 67 |